Losing a family member is hard enough. For families in Kingwood, discovering they didn't leave behind a will can turn a difficult time into a legal and emotional maze. When someone in Texas passes away without a valid will, the state has a default plan for who gets what. This is called intestate succession, and it relies on a strict legal formula to distribute property among surviving relatives.

Think of it as the state's "will" for you, and it rarely lines up with what you or your loved one would have wanted.

How Texas Intestate Succession Works

When a person dies "intestate," Texas law steps in with a rigid, one-size-fits-all solution based purely on family relationships—spouse, children, parents, and so on. The system is designed to be predictable, but it completely ignores your personal relationships, close friendships, or the unique needs of your loved ones.

For families here in Kingwood and the surrounding Humble and Porter communities, this can lead to some truly surprising and often heartbreaking results.

The Real-World Impact on Your Family

By not having a will, you're essentially handing over all your most important decisions to a probate court. You lose the power to say who inherits your assets, who should raise your minor children, and who you trust to wrap up your affairs. A judge will make those calls based on legal precedence, not on your personal wishes.

Here’s what that can look like for a family in Northeast Houston:

- Your Property Goes to Unexpected People: A distant cousin you barely know could inherit a share of your estate, while your devoted, unmarried partner of 20 years gets nothing.

- It Can Spark Family Fights: Grieving family members can easily get drawn into disputes when an impersonal law dictates who gets what, creating rifts that may never heal.

- The Process Becomes Longer and More Expensive: Proving who the legal heirs are often requires more court involvement, time, and money than simply probating a straightforward will.

The bottom line is, the state's plan becomes your estate plan. That’s why our Kingwood attorneys always stress the importance of being proactive. Taking the time to understand how to write a will is one of the most powerful things you can do to protect your family from the confusion of intestate succession.

The Texas Estates Code lays out a precise formula for distributing property. It follows a strict hierarchy of heirs, starting with your spouse and children, then moving to parents and other relatives. The shares they receive depend entirely on who is still living. It’s a legal safety net, not a substitute for your own plan.

For many families, facing the probate process without a will adds a heavy layer of legal stress during an already overwhelming time. At The Law Office of Bryan Fagan, we bring clarity and compassion to these complex situations. If you're a Kingwood resident navigating an intestate estate, you don’t have to figure it out alone. Call our Kingwood office for a free consultation to see how we can help.

Community Property vs. Separate Property in Texas

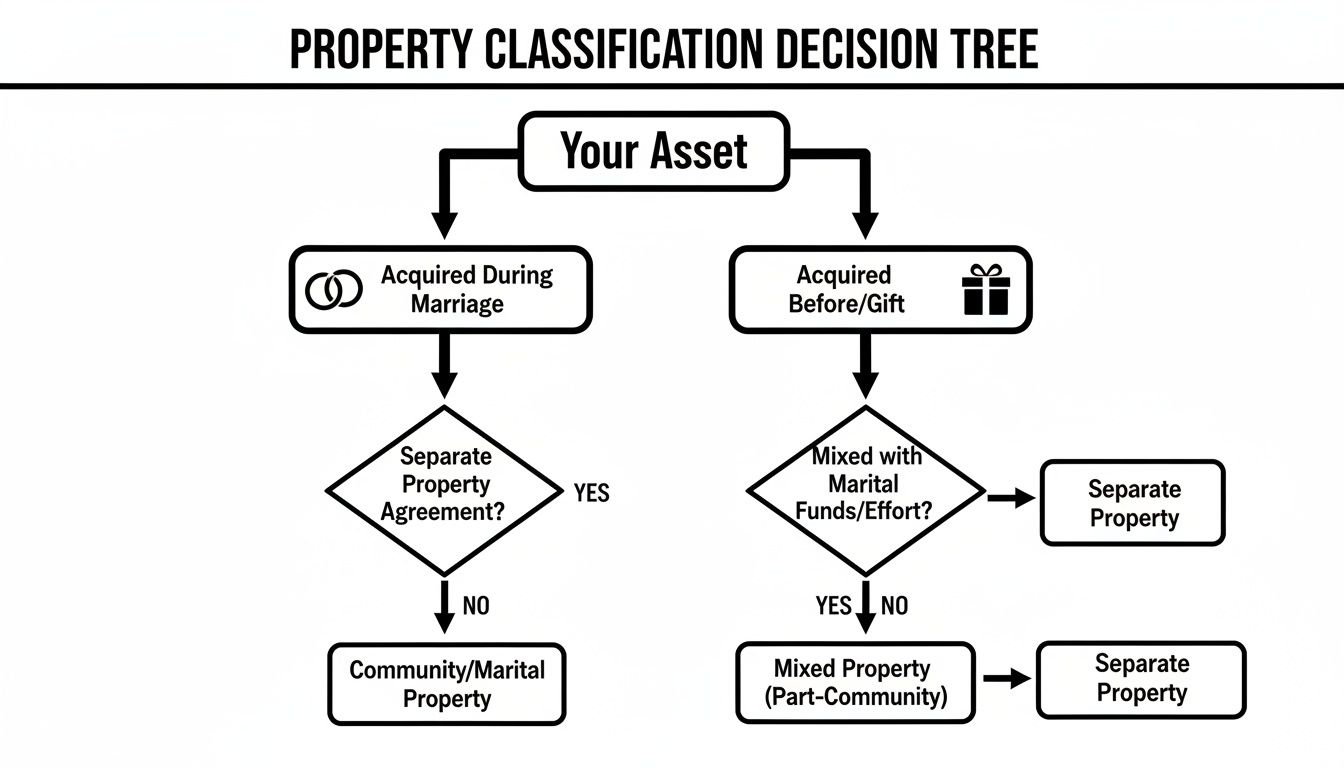

Before we can even look at the Texas inheritance chart, we have to tackle one of the biggest concepts in Texas law: the difference between community property and separate property. This idea is the bedrock of how assets get divided, not just when someone passes away, but in family law, too. For our clients here in Kingwood, Humble, and Porter, the easiest way to think about it is in simple, real-world terms.

Imagine you and your spouse are a team. Everything the team earns or buys while you're married belongs to the team equally. That’s community property. But anything you owned before you got married, or anything given just to you during the marriage (like an inheritance from your aunt), is yours alone. That’s separate property.

Defining Community Property

Texas law starts with a powerful assumption: anything you or your spouse got from the day you said "I do" until the day one of you passed away is community property. It doesn't matter whose name is on the title or which paycheck paid for it.

This "team" property usually includes things like:

- Income and Wages: All the salary, bonuses, and paychecks earned by either of you during the marriage.

- Real Estate: The family home you bought in Kingwood while married is a classic example, even if only one spouse is on the deed.

- Vehicles and Personal Items: Cars, furniture, and jewelry purchased with money earned during the marriage.

- Retirement Accounts: The value of a 401(k) or pension that grew during the years you were married.

This is so important because when there’s no will, the surviving spouse has very strong rights to this community property. But, as you'll see, those rights can shift dramatically depending on who else is in the family picture.

Identifying Separate Property

Separate property is the exception to the "team" rule. It’s anything owned by one spouse that isn't part of the shared marital estate. Since the law automatically assumes property is community, the person claiming an asset is separate has to prove it with what’s called "clear and convincing evidence."

Separate property falls into a few distinct buckets:

- Property you owned before the marriage.

- Property you received during the marriage as a gift or inheritance specifically to you.

- Money you received from a personal injury lawsuit, though any portion meant to cover lost wages during the marriage might be considered community property.

So, if your parents gave you $20,000 as a gift after you were married and you put it into a bank account under your name only, that money stays your separate property. The trouble starts when you deposit that gift into a joint checking account where it gets mixed up with paychecks and other shared funds. This "commingling" can erase its separate identity, turning it into community property over time. Keeping assets truly separate is a crucial strategy we often discuss when helping our Kingwood clients protect assets during a divorce.

The classification of property is the first and most critical step in applying the Texas intestate succession chart. A mistake here can completely change who inherits your assets, which is why working with an experienced Northeast Houston attorney is so important.

A big piece of the puzzle is understanding how property ownership is officially documented. For instance, digging into topics like Texas Warranty Deeds helps clarify how real estate titles work, which is often central to settling an estate.

Ultimately, this distinction between property types drives the entire probate process when there's no will. It sets what your surviving spouse automatically gets and what’s left for your children or other relatives under the state's strict formula. If you're navigating this in the Kingwood area, don’t go it alone. Let our team at The Law Office of Bryan Fagan provide the clear, practical guidance you need.

How the Texas Intestate Succession Chart Really Works

So, let's get to the heart of the matter for families across Kingwood and Northeast Houston: how does this all actually play out? The Texas intestate succession chart isn’t a single, one-size-fits-all rule. It’s more like a series of “if-then” scenarios, and the outcome depends entirely on who survived the person who passed away.

Think of it as a roadmap with different forks. The path your loved one's estate takes depends on whether they were married, had children, or had other living relatives. We'll walk through the most common situations we see with our local clients, translating the legal jargon into real-world outcomes.

The first step in using this roadmap is always to sort the assets into the two key buckets we've discussed: community and separate property. This simple decision tree shows exactly how that classification happens.

As you can see, the timing of when property was acquired is the single most important factor in determining its legal status here in Texas.

To make this even clearer, we’ve put together a detailed chart that shows exactly how property gets divided in different family situations.

Texas Intestate Succession Distribution Chart

This table breaks down the complex inheritance rules into the most common scenarios. It clearly shows how community property (the assets of the marriage) and separate property (assets owned individually) are treated differently under Texas law.

| Decedent's Family Situation | Community Property Distribution | Separate Property Distribution |

|---|---|---|

| Married with Children (all from this marriage) | Surviving spouse inherits 100%. | Spouse gets 1/3 of personal property and a life estate in 1/3 of real estate. Children inherit the remaining 2/3. |

| Married with Children (from a prior relationship) | Spouse keeps their 50% share. The decedent's 50% share goes to all of their children. | Spouse gets 1/3 of personal property and a life estate in 1/3 of real estate. Children inherit the remaining 2/3. |

| Married with No Children | Surviving spouse inherits 100%. | Depends on other relatives. Spouse gets all personal property, but real estate is split with parents or siblings if they exist. |

| Unmarried with Children | Not applicable. | The entire estate is divided equally among the children (per stirpes). |

| Unmarried with No Children | Not applicable. | The estate goes to parents. If no parents, then to siblings. If no siblings, then to more distant relatives. |

This chart is a powerful tool for understanding the default settings the state imposes. Now, let's unpack a few of these common scenarios.

Married with Children

This is one of the most frequent and, frankly, most misunderstood situations. How property is divided hinges on a crucial detail: are the children from the current marriage or a previous one?

If all children are from the current marriage: This is the simpler case. The surviving spouse keeps 100% of the community property. They also get one-third of the separate personal property and the right to use one-third of the separate real estate for their lifetime. The children inherit the remaining two-thirds of the separate property.

If the deceased has children from a previous relationship: This is where things get complicated for many Humble families. The surviving spouse still keeps their half of the community property. But the deceased's half of the community property goes directly to all of their children—from both the current marriage and any previous ones. The rules for separate property don't change.

That second point is often a shock. It means the family home, if it's community property, could suddenly be co-owned by the surviving spouse and their stepchildren.

Married with No Children

When a married person in Texas dies without any children or grandchildren, the distribution shifts to focus on other relatives.

The surviving spouse automatically inherits all of the community property. Simple enough.

But for separate property, the rules are a bit more complex:

If the deceased's parents are alive: The surviving spouse gets all the separate personal property. However, they only receive half of the separate real estate. The other half goes straight to the deceased's parents.

If only one parent is alive (and no siblings): Same as above—the spouse gets all personal property and half the real estate. The surviving parent gets the other half of the real estate.

If there are no surviving parents: Finally, the surviving spouse inherits all of the separate property.

Unmarried with Children

For a single person in Kingwood who passes away leaving children, the rules are very straightforward. Their entire estate—with no community/separate property distinction—is divided equally among their children. The legal term for this is per stirpes, which just means each branch of the family tree gets an equal share.

For example, if an unmarried person dies with three kids, each child gets one-third of the estate. If one of those children had already passed away but left two kids of their own (the decedent's grandchildren), those grandkids would split their parent's one-third share.

Unmarried with No Children

When someone dies without a spouse or any descendants, Texas law has to look further up the family tree to find heirs. This can sometimes lead to some pretty unexpected results.

Here’s the order of inheritance:

- Surviving Parents: If both parents are alive, they inherit the whole estate, split right down the middle. If only one is alive, that parent gets everything.

- Surviving Siblings: If neither parent is alive, the estate is divided equally among the deceased's siblings.

- Nieces and Nephews: If a sibling has already passed away, their share goes to their own children (the decedent's nieces and nephews).

- Grandparents and Beyond: If there are no parents, siblings, or nieces/nephews, the law keeps searching for the closest living relatives, starting with grandparents and moving on to aunts, uncles, and cousins.

This entire framework is what legal experts call a modified parentelic system. The law follows bloodlines to determine who inherits based on the family's structure at the time of death, applying different rules for community and separate property. For instance, when a married person dies intestate with children, the law mandates a specific split of community property: the surviving spouse receives exactly one-half, and the children inherit the other half in equal shares. You can discover more about the technical legal basis for these rules and how they are applied in Texas courts.

This rigid structure really highlights why having a will is so critical. It's the only way to make sure your property goes to the people you actually choose, rather than letting a state-mandated formula make that decision for you.

Navigating the Texas intestate succession chart can feel like solving a complex puzzle, especially when you are also grieving a loss. At The Law Office of Bryan Fagan, our Kingwood attorneys are here to provide the clarity and guidance you deserve. If you are facing the probate process for a loved one who died without a will, give us a call for a free, no-obligation consultation to understand your rights and options.

What About More Complicated Family Situations?

Real life rarely fits into a neat and tidy chart. While the standard rules of Texas intestate succession cover the basics, most families we work with in Kingwood, Humble, and across Northeast Houston have questions about the “what ifs.” What about blended families, adoptions, or half-siblings? These are the real-world scenarios that can cause the most stress and confusion.

It’s worth noting that Texas law has come a long way. Before a major overhaul that began in the early 1970s, the state’s rules were archaic and often led to deeply unfair results, particularly for children born outside of a marriage. A landmark Supreme Court case in 1973 finally forced Texas to modernize its laws, ensuring a more level playing field for all potential heirs. You can actually dig into the history of these legal changes to see how we got the rules we have today.

Our firm has deep experience applying these more nuanced rules to protect the rights of Kingwood families, no matter how their family tree is structured.

How Adopted Children Are Treated

This is one of the most straightforward and compassionate parts of Texas inheritance law. Once a child is legally adopted, the law sees them as being in the exact same position as a biological child.

This means an adopted child has the full and complete right to inherit from their adoptive parents, just as the intestate succession rules outline. The flip side is that the adoption legally severs the child's inheritance rights from their biological parents. As far as the law is concerned, the adoptive family is their only family for inheritance purposes.

The Status of Stepchildren and Foster Children

Here’s where many people are caught by surprise. Under the default Texas rules, stepchildren have zero automatic right to inherit from a stepparent. The same goes for foster children.

For inheritance rights to kick in, that parent-child relationship must be legally finalized through a formal adoption. It doesn't matter if a stepparent raised a child from infancy and was the only parent they ever knew. If there's no will, the law simply doesn't recognize that relationship for inheritance. This is one of the most compelling reasons for blended families in the Porter area to have an estate plan. A will is the only way to guarantee a beloved stepchild is included.

Without a will, a stepchild you've loved and supported for decades could receive nothing, while a biological relative you've never met could inherit your property. This is a common and heartbreaking outcome that we help Kingwood families avoid through proper estate planning.

Inheritance Rights of Half-Siblings

What happens when brothers and sisters only share one parent? Texas law draws a line here, but it only matters when you’re dealing with separate property.

Here’s the breakdown:

- Community Property: The idea of "half-siblings" doesn't change a thing.

- Separate Property: This is where it gets tricky. When it comes to inheriting separate property, a half-sibling is only entitled to half as much as a full-blood sibling. For example, if someone dies leaving a full sister and a half-brother, the full sister would inherit two-thirds of the separate property, while the half-brother would only get one-third.

This "half-share" rule can lead to some complicated math, especially with larger families. It really shows how precisely the law tries to follow bloodlines when there isn’t a will to provide other instructions.

When There Are No Living Relatives

It's rare, but what if someone in Northeast Houston passes away with absolutely no traceable family? No spouse, kids, parents, siblings, nieces, nephews, grandparents, or even distant cousins.

In this unlikely event, the person's property goes through a legal process called escheat. This simply means that the entire estate—every piece of real estate and all personal property—is turned over to the State of Texas. The assets essentially become public property. This is the state’s ultimate backstop to ensure property doesn't sit in limbo forever.

These complex scenarios show that relying on the state's default plan can lead to results you never would have wanted. At The Law Office of Bryan Fagan, we provide clear, compassionate guidance to help you make sense of it all. If your family has any of these unique situations, contact our Kingwood office for a free consultation to discuss your specific case.

The Legal Process of Proving Heirship in Kingwood

Knowing who inherits according to the Texas intestate succession chart is one thing; proving it in a Harris County probate court is another. For families in Kingwood, this is where the theoretical rules become a court-recognized reality. The formal process, called a Proceeding to Determine Heirship, is how a judge legally identifies the person’s heirs and figures out who gets what share of the estate.

When an estate needs to be managed and there's no will, someone with an interest in the estate has to file an application to get the ball rolling. The court will then appoint an "attorney ad litem"—a neutral attorney whose job is to track down and represent any unknown or missing heirs. This ensures everyone's potential rights are protected.

Gathering the Necessary Documents

To successfully prove who the heirs are, you have to back up your claim with hard evidence. It’s not enough to just explain the family tree to the judge; you need official documents to paint a clear and undeniable picture.

Your case will be built on a foundation of vital records, including:

- Death Certificate: This is the official document that kicks off the probate process.

- Birth Certificates: Essential for establishing the relationships between the deceased and their children or other relatives.

- Marriage Licenses: Used to prove a spousal relationship.

- Divorce Decrees: Critical for showing that a previous marriage was legally ended.

For a lot of Kingwood families, finding these old records can be a real headache. Texas didn't start formally registering vital statistics until 1903, and statewide marriage records only began in 1966. If you're dealing with an older marriage, you might have to dig through individual county clerk offices, which can be a slow and frustrating search.

The Affidavit of Heirship Alternative

In a few specific situations, you might be able to skip a formal court proceeding. If the estate’s only major asset is real estate, an Affidavit of Heirship can sometimes be used to transfer the property title. This is a sworn legal statement, signed by two witnesses who have no financial stake in the estate, that lays out the deceased's family history and identifies the heirs.

An Affidavit of Heirship is not a court order. It's simply filed in the county property records. Because of this, it's a less secure solution—title companies might refuse to accept it, and it can be challenged by another party down the road.

While this route is often cheaper and quicker, it comes with some serious risks. A formal heirship proceeding results in a final, binding court order that provides much stronger legal protection and peace of mind. For other specific situations, an even simpler process like a Muniment of Title could be possible, but that path generally requires a valid will.

Navigating the probate courts in Northeast Houston demands a sharp eye for detail and a solid grasp of legal procedure. The attorneys at The Law Office of Bryan Fagan are here to handle this entire process for you, from tracking down documents to representing your family in court. Contact our Kingwood office today for a free consultation to figure out the best path forward.

Take Control of Your Legacy with a Kingwood Attorney

That Texas intestate succession chart we went through? It’s a clear, logical, but completely impersonal roadmap for your assets. It’s the state’s default plan, a legal safety net designed to work for everyone, which means it’s not tailored for anyone—especially not for you.

Relying on this system means you’re letting the state have the final say on where your life’s work goes. For families here in Kingwood and Humble, that’s a tough pill to swallow. It’s not just about money and property; it's about the legacy you spent a lifetime building.

The state’s rigid formula can’t possibly understand your family’s unique dynamics. It doesn't know about the stepchild you raised as your own, the nephew you wanted to help through college, or the specific heirlooms you promised to a dear friend. This impersonal approach can easily lead to hurt feelings, confusion, and even legal battles among the people you love most.

The good news is, you don’t have to accept the state’s one-size-fits-all plan. You have the power to create your own.

Secure Your Family's Future Today

Taking the time to draft a will, explore a trust, or put other estate planning documents in place is one of the most thoughtful things you can do for your family. It replaces legal guesswork with your personal instructions, ensuring your final wishes are honored precisely as you intended.

You get to decide who inherits your assets, who you trust to raise your minor children, and who will be in charge of settling your affairs. These are profoundly personal decisions that should never be left to a stranger in a courtroom.

A well-crafted estate plan is your final gift to your loved ones. It gives them clarity and a path forward during what will already be an incredibly difficult time.

At The Law Office of Bryan Fagan, we're not just attorneys; we're your neighbors in the Kingwood community. We’ve sat down with countless families from Northeast Houston to Porter, listening to their stories and helping them create solid, legally-sound estate plans that provide real peace of mind.

You worked hard to build your legacy. Let us help you protect it.

Contact our Kingwood office today to schedule a free, no-obligation consultation. We’re here to listen and help you build a plan that secures your family’s future, your way.

Your Top Questions About Dying Without a Will in Texas

When a loved one passes away without a will, it's natural for a lot of questions—and worries—to surface. Here in Kingwood, we often hear the same concerns from families trying to navigate this difficult process. Let’s clear up some of the most common ones.

Who Is on the Hook for My Loved One’s Debts?

This is probably the biggest source of stress for families. The good news is that in Texas, you are not personally responsible for a relative’s debts.

The estate itself is responsible. Before anyone can inherit a single dollar, the estate’s assets are used to pay off any outstanding debts, taxes, and final expenses. Think of it like the estate has to settle its own financial affairs first, and only what's left over is passed on to the heirs.

Doesn't My Spouse Automatically Inherit Everything?

It's a common assumption, but it’s not always true. A surviving spouse only inherits the entire estate if the deceased either had no children at all, or if all of their children were from that one marriage.

The moment children from a previous relationship enter the picture, the rules change. In that scenario, those children have a right to the deceased's share of the community property, a fact that often catches local families by surprise.

How Long Does This Process Take in Kingwood?

The timeline for an intestate probate case in Harris County really depends. A simple, straightforward estate with clear heirs might wrap up in a few months.

However, if heirs are difficult to track down, if there are disagreements among family members, or if the assets are complicated, the process can easily drag on for a year or even longer. Having a skilled local Kingwood attorney can definitely help keep things moving as efficiently as possible.

Can We Fight an Heirship Decision?

Yes, you can challenge an official heirship determination in court. This typically happens when someone feels they were unfairly left out or that someone else was wrongly included as an heir.

Be warned, though: contesting heirship is a serious legal battle with very strict deadlines. If you find yourself in this situation, getting legal advice right away is absolutely critical.

Trying to sort out an estate without a will can feel like navigating a maze in the dark. You don't have to go through it alone.

The team at The Law Office of Bryan Fagan – Kingwood TX Lawyers is here to offer the clear-headed, compassionate guidance your family needs. We proudly serve our neighbors in Kingwood, Humble, and throughout Northeast Houston, helping them protect their family’s legacy and honor their loved ones.

Schedule your free, no-obligation consultation today by visiting us at https://kingwoodattorneys.com.