When you've spent a lifetime building something meaningful here in Kingwood, the last thing you want is for that legacy to get tied up in court or for your family's future to be left to chance. Many people in our community assume a simple will is enough, but as a local Kingwood law firm, we’ve seen time and again that a trust offers a far more robust and private way to protect what you’ve worked for.

Think of a trust less as a complex legal document and more as a detailed, personalized instruction manual for your assets. It’s your voice, ensuring your wishes are followed down to the letter.

At The Law Office of Bryan Fagan – Kingwood TX Lawyers, we've noticed a real shift. More and more families from Kingwood, Humble, and all over Northeast Houston are opting for trusts. They're seeking genuine peace of mind, the kind that comes from knowing their loved ones won't be stuck navigating the public, and often drawn-out, probate court process right here in Harris County.

Your Private System for Protecting Your Assets

One of the biggest reasons families in Kingwood come to us for a trust is to sidestep the probate process. This is a huge advantage under Texas law, as it keeps your family’s financial matters completely private. It also means your assets can get to your beneficiaries much faster and with a lot less headache. There are many good strategies on how to avoid probate court, and creating a trust is one of the most effective.

For a more detailed look at how this works specifically in our state, we've put together a guide on how to avoid probate in Texas.

A trust gives you an incredible amount of control, letting you manage your wealth even after you're gone. You get to decide not just who gets what, but also how and when they receive it. This is a game-changer in many common family situations we see in Northeast Houston:

- You can safeguard a young beneficiary’s inheritance, making sure it’s there for them when they’re old enough to handle it responsibly.

- It allows you to provide for a loved one with special needs without accidentally disqualifying them from essential government benefits.

- If your beneficiaries aren't experts in finance, you can appoint a professional to manage the assets on their behalf.

Finding Security When You Can't Trust the System

Let’s be honest—trust in big institutions isn't what it used to be. The latest Edelman Trust Barometer really drives this point home. It shows that only 62% of people globally trust businesses, and 48% of Americans have little to no trust in major institutions. For Kingwood families, this highlights a critical truth: a well-crafted trust becomes your own reliable, private system for protecting what matters most.

By creating a trust, you're taking control. You're building your own legally-binding safeguard, tailored specifically to your family's needs, completely independent of outside uncertainties.

Our team at The Law Office of Bryan Fagan is based right here in Kingwood. We understand the local community and we know Texas law inside and out. We’re here to help you build a plan that gives you and your family lasting security.

If you’d like to explore how a trust could work for you, we encourage you to schedule a free, no-pressure consultation at our Kingwood office. We are here to listen and provide the trusted representation you deserve.

Choosing the Right Trust for Your Family's Needs

When a family from Porter or Humble comes into our Kingwood office, one of the first things we make clear is that a "trust" isn't a single, one-size-fits-all product. It’s more like choosing the right tool for a specific job. You need to know what you want to accomplish first, and only then can you pick the legal structure that gets you there.

The world of estate planning can seem complicated, but under Texas law, most common options boil down to a few key differences. Understanding these is the first practical step in learning how to set up a trust that genuinely protects your family's future.

The Revocable Living Trust: Your Go-To for Flexibility

For the majority of Kingwood families we work with, the Revocable Living Trust is the ideal starting point. The name gives it away: it's "revocable," which means you can change your mind, modify the terms, or even dissolve it entirely as long as you're living. You never give up control of the assets inside it.

This flexibility is its greatest strength. Life changes, and your trust should be able to change with it. If you sell your house and move, you just update the trust. If your family grows or relationships shift, you can adjust who gets what. Its main job is to hold your assets so that when you pass away, they can be distributed to your loved ones without the delay, cost, and public nature of the probate court.

The Irrevocable Trust: When Ironclad Protection Is the Goal

On the other end of the spectrum is the Irrevocable Trust. This one is built for permanence. Once you transfer property into it, those assets are no longer legally yours, and you generally can't change the terms.

So, why would anyone choose to give up that much control? The simple answer is powerful asset protection.

By legally separating the assets from your personal estate, you can shield them from future creditors, lawsuits, or the devastating financial hit of long-term care costs. While this seems abstract, the numbers are telling. Since 2010, irrevocable trusts have protected over 68% more family wealth from being lost to creditors or legal claims in high-net-worth cases in the U.S.

The choice between revocable and irrevocable isn't about which is "better"—it's about aligning the tool with your main objective. Are you prioritizing flexibility or protection? For a deeper dive, we've put together a guide on the differences between revocable and irrevocable trusts in Texas.

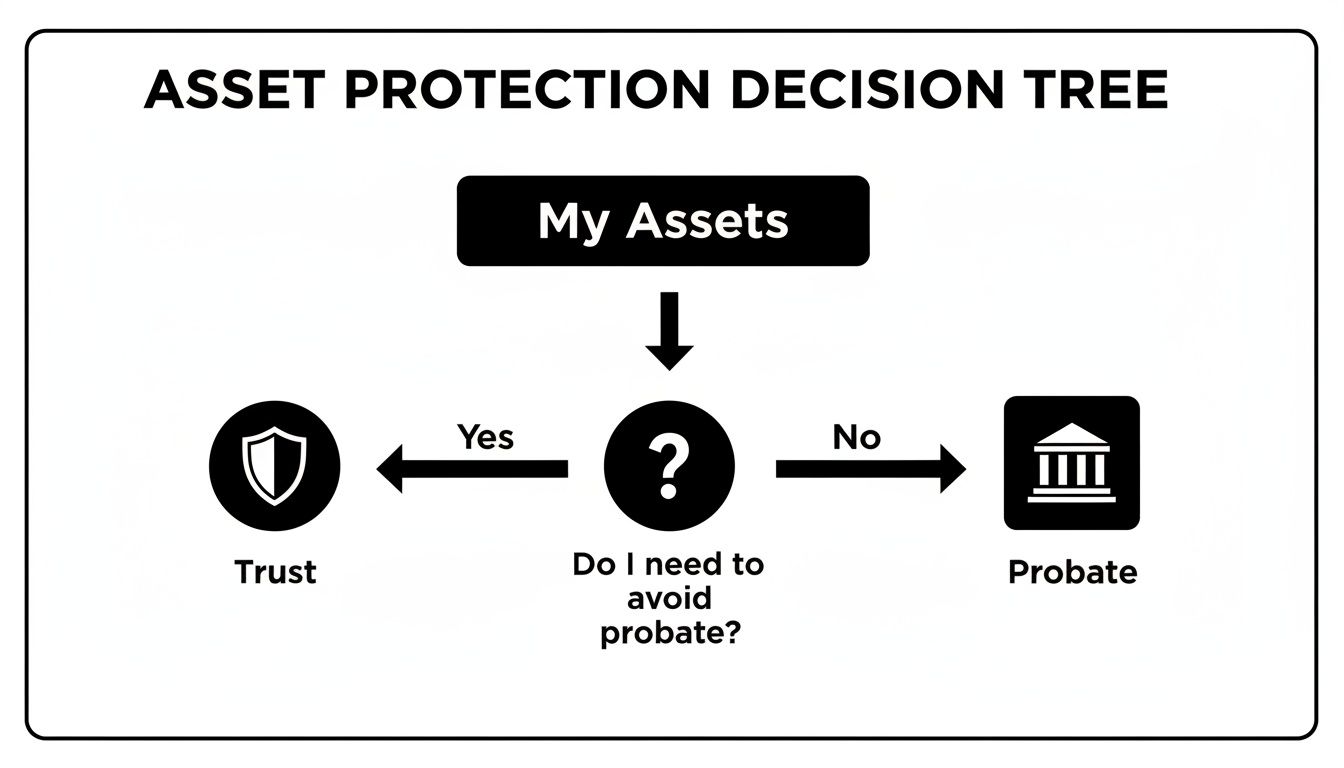

This diagram really simplifies the fundamental decision you're making: either shield your assets inside a trust or leave them to navigate the public probate process.

As you can see, a trust creates a direct line of protection for your assets, whereas skipping this step means everything must go through the court system.

Comparing Common Trust Types in Texas

To help you get a clearer picture, this table breaks down the most common trust types we use to help families in the Kingwood area achieve their personal and financial goals.

| Trust Type | Primary Purpose | Key Benefit | Best For… |

|---|---|---|---|

| Revocable Living Trust | Probate avoidance and streamlined asset management. | Flexibility. You can amend or revoke it at any time. | Most families who want to simplify the transfer of their estate to heirs. |

| Irrevocable Trust | Asset protection, estate tax reduction, and long-term care planning. | Protection. Shields assets from creditors, lawsuits, and your personal estate. | Individuals with significant assets or those concerned about future liabilities. |

| Special Needs Trust | Protecting eligibility for government benefits for a disabled beneficiary. | Preserves Benefits. Allows an heir to receive an inheritance without losing essential aid. | Families with a child or dependent who has special needs. |

| Marital (QTIP) Trust | Providing for a surviving spouse while preserving assets for other heirs. | Control Over Final Heirs. Ensures children from a prior marriage inherit after the spouse passes. | Blended families or those wanting to balance the needs of multiple sets of heirs. |

Each of these structures serves a very specific purpose. The key is identifying your unique family situation and choosing the one that fits perfectly.

Specialized Trusts for Unique Family Situations

Beyond the two main types, Texas law allows for a variety of specialized trusts designed to solve very specific family challenges. These are the tools we reach for when a family has circumstances that need a more precise approach.

Here are a couple of examples we often draft for our Kingwood clients:

- Special Needs Trusts (SNTs): Imagine you have a child who relies on government benefits like Medicaid or SSI. Leaving them an inheritance directly could instantly disqualify them from that essential aid. An SNT solves this by holding the assets for their benefit, allowing a trustee to pay for things that improve their quality of life—like therapy, education, or recreation—without disrupting their government assistance.

- Marital Trusts (often called "QTIP" Trusts): These are absolute lifesavers for blended families. A marital trust can provide financial security for your surviving spouse for the rest of their life, while legally guaranteeing that whatever is left over will eventually pass to your children from a previous marriage. It’s a brilliant way to take care of everyone and prevent potential conflict down the road.

Picking the right trust is the foundation of a solid estate plan. It’s about so much more than paperwork; it’s about making your wishes for your family legally enforceable. Our Kingwood team is here to help you understand these options in a simple, straightforward way.

Defining the Key Roles in Your Texas Trust

Think of a trust as a private rulebook you create for your assets. To make sure the rules are followed, you need to assign a few key players. Getting these roles right is the foundation of a successful trust that works for your family here in Kingwood.

These aren't just fancy titles on a legal document; they are positions of real responsibility. Frankly, choosing the right people is one of the most critical decisions you'll make in this whole process.

The Grantor: The Person in Charge

First up is the Grantor (you might also see this called a Settlor or Trustor). This is you—the creator of the trust and the one who puts your property into it.

When you create a revocable living trust, you're still in the driver's seat. You call the shots, you set the rules, and you can change your mind anytime. You are the architect, designing a plan that spells out exactly how you want your legacy managed.

The Beneficiary: The People Who Benefit

Next, you have the Beneficiary. This is the person, group of people, or even a charity that will receive the benefit of the trust's assets. You can name primary beneficiaries and also "contingent" beneficiaries, who would step in if your first choice can't inherit for some reason.

It might sound strange, but while you're alive, you're typically the main beneficiary of your own trust. After you're gone, the people you’ve designated—your kids, grandkids, or other loved ones in the Northeast Houston area—become the beneficiaries, and they receive the assets according to your instructions.

The Trustee: The Manager of the Plan

This is probably the most important role you’ll need to fill: the Trustee. The Trustee is the person or institution you put in charge of managing the trust. Their job is to follow your instructions and always act in the best interests of the beneficiaries. In Texas, this is called a fiduciary duty, and it's a serious legal obligation.

While you are alive and well, you will almost certainly be your own Trustee. You’ll manage your property just like you do now. The real decision-making comes in when you name a Successor Trustee. This is the person who takes over if you become incapacitated or after you pass away.

This individual is going to be responsible for some heavy lifting:

- Taking inventory of everything in the trust.

- Paying off final bills and taxes using trust funds.

- Distributing the assets to your beneficiaries exactly as you laid out.

- Making smart investment choices to preserve the trust’s value.

Choosing your Successor Trustee requires some serious thought. This person has to be responsible, trustworthy, and able to handle money and paperwork without letting their own emotions get in the way.

You really have two main paths to go down here, and the right one depends on your family situation and how complex your finances are.

A Trusted Family Member or Friend

For many folks in Kingwood and Humble, this is the most common choice. Appointing a responsible child, a sibling, or a close friend feels natural. They know you, they know the family, and they usually won’t charge a fee.

- Pros: They have deep personal knowledge of your family's dynamics and wishes. There are typically no management fees.

- Cons: They might not have the financial savvy needed, could get overwhelmed by the job, or run into conflicts with other relatives.

A Professional Corporate Trustee

Your other option is to hire a professional, like the trust department of a bank or a dedicated trust company. This is often the best move for larger estates or if you anticipate any family disagreements down the road.

- Pros: You get professional expertise in asset management, tax law, and legal compliance. They act as an impartial third party, which can stop family squabbles before they start.

- Cons: They charge for their services, usually an annual fee based on the trust's value. This can eat into the assets over time.

Picking the right people for these jobs is what makes your trust work. It turns a stack of paper into a living, breathing plan that protects your family. At The Law Office of Bryan Fagan, we can walk you through these choices to help you find the solution that brings you real peace of mind.

Making It Real: The Critical Step of Funding Your Trust

It’s one of the biggest—and most dangerous—misconceptions our Kingwood law firm sees. A family signs their trust documents, breathes a sigh of relief, and assumes their work is done. But a beautifully drafted trust is worthless if it doesn't actually own anything. It's just an empty box.

The process of transferring your assets into that box is called funding the trust. Without this crucial step, your assets will likely end up right where you didn't want them: in probate court. All the time and money you spent creating the trust will have been for nothing.

Think of it this way: you’ve built a secure vault to protect your family’s future, but you haven't moved any of your valuables inside. Funding is the act of putting everything in the vault and locking the door. For any family in Kingwood or Northeast Houston figuring out how to set up a trust, getting this part right is everything.

Getting Your Real Estate into the Trust

For most people, their home is their biggest asset. To move your house into your trust, you have to officially change the legal ownership from your name to the trust's name. This isn't just a piece of paper you sign at home; it requires preparing and recording a brand new deed with the Harris County Clerk's Office.

The new deed will change the owner from "John and Jane Smith" to something like, "John and Jane Smith, Trustees of the Smith Family Revocable Trust." It’s a formal legal step, but it’s what empowers your successor trustee to manage or sell the property later without needing a judge's permission.

Moving Financial Accounts Over

Your bank accounts, brokerage portfolios, and other financial assets need to be retitled as well. This typically means a trip to the bank or a call with your financial advisor, with your trust documents in hand.

Each institution has its own process, but the outcome is always the same: changing the account's legal owner from you as an individual to you as the trustee. You'll still write checks, make deposits, and manage investments exactly as before. The only difference is that, legally, the trust now owns the account.

A Word of Caution for Humble and Porter Families: I've seen firsthand what happens when a family funds almost everything but forgets a single investment account. That one overlooked asset can derail the entire plan, forcing that part of the estate into probate and causing the exact delays and fees the trust was meant to avoid. A thorough checklist is your best defense against this common mistake.

Handling Beneficiary Designations

Some of your most valuable assets can't be retitled into a trust's name. These are what Texas law calls non-probate assets, and they pass directly to the people you name on a beneficiary form.

This category includes things like:

- Life Insurance Policies: The death benefit is paid directly to your named beneficiary.

- Retirement Accounts: Your 401(k), IRA, 403(b), and similar accounts all have beneficiary forms.

- Annuities: The value of the annuity passes to a specific person upon your death.

For these, you'll often name your trust as the primary or contingent beneficiary. This funnels the money into the trust after you're gone, where your successor trustee can manage it according to the detailed rules you've laid out. You can dive deeper into this topic in our guide to non-probate assets in Texas.

Getting this right is absolutely critical. Naming the wrong beneficiary—or naming one incorrectly—can trigger major tax headaches, particularly with retirement accounts. This is one area where expert guidance is truly indispensable.

A Quick-Reference Guide to Funding Your Assets

To give you a clearer picture, here’s a simple breakdown of how different assets are moved into a trust.

| Asset Type | Funding Method | Key Action Required |

|---|---|---|

| Real Estate (Your Home) | Retitling the Deed | Prepare and record a new deed that transfers legal ownership to the trust. |

| Bank Accounts | Changing Account Ownership | Work with your bank to formally change the account title to the name of the trust. |

| Investment Accounts | Changing Account Ownership | Contact your financial advisor to retitle the brokerage account in the trust's name. |

| Life Insurance | Updating Beneficiary | Fill out a new beneficiary designation form to name the trust. |

| Retirement Accounts | Updating Beneficiary | Carefully update the beneficiary form. Always consult an attorney first due to complex tax rules. |

| Personal Property | Assignment of Property | Create a legal document that assigns ownership of your untitled items (like furniture, jewelry, or art) to the trust. |

Funding isn't just paperwork; it’s the step that activates your entire estate plan. It’s what ensures your wishes are actually carried out and your Kingwood family is protected. At The Law Office of Bryan Fagan, we walk our clients through every detail of this process to make sure nothing gets missed. If you’re ready to ensure your trust will work as intended, we invite you to schedule a consultation with our Kingwood team.

Finalizing and Maintaining Your Estate Plan

You’ve done the hard work of planning—selecting the right trust, appointing the key players, and getting your assets in order. Now you're on the home stretch. The final step to make your trust legally binding in Texas is to sign the documents in front of a notary public. It’s a simple formality, but it’s absolutely crucial.

But don't make the mistake of thinking a trust is a "set it and forget it" kind of deal. A better analogy is a garden; it needs regular attention to stay healthy and do its job. The most successful estate plans are the ones that are treated as living documents, evolving right alongside you and your family.

Your Trust Is a Living Document

Life here in Kingwood is always moving, and your family's circumstances will change. The plan that fits you perfectly today might not be the right one in ten years. That's why regular reviews are so important.

A revocable living trust, by its very nature, is built to be flexible. You can easily amend it to add a new grandchild, remove a beneficiary, or even swap out your successor trustee. The real question isn't if you'll need to update it, but when.

Certain life events should always be a trigger for a trust review:

- Marriage or Divorce: These major life changes will have a huge impact on your family structure and financial responsibilities.

- Birth or Adoption: A new child or grandchild is a wonderful reason to update your plan to include them.

- Big Financial Shifts: If you sell a business, come into an inheritance, or see a major change in your asset portfolio, your trust should reflect that.

- A Beneficiary's Situation Changes: If an heir develops special needs, runs into financial trouble, or passes away, you'll need to adjust your plan.

- Texas Law Changes: Estate and tax laws don't stay the same forever. Your trust needs to be checked to ensure it's still compliant and effective.

We generally recommend our clients in Humble and Porter sit down with us at our Kingwood office to review their trust documents every three to five years. Even if nothing major has happened, this quick check-in ensures your plan stays perfectly aligned with your wishes and gives you maximum protection.

The Ongoing Role of Trust Administration

After you're gone, your successor trustee's work begins. This is when trust administration kicks in. Their job is to manage and distribute the trust's assets exactly as you laid out, all while staying out of court. This is where all your careful planning really pays dividends for your family.

Their responsibilities are significant and include:

- Notifying all beneficiaries and heirs.

- Locating and managing all the trust's assets.

- Paying off any final debts, taxes, and administration expenses.

- Distributing the remaining assets to the beneficiaries according to your instructions.

It’s easy to see why choosing a successor trustee who is organized, responsible, and a good communicator is so critical for a smooth transition.

Finalizing your estate plan is also about looking at the entire financial picture. It's smart to consider different estate tax planning strategies to protect your legacy for future generations. A trust is a powerful tool, but it works best when it's part of a comprehensive plan. This kind of foresight leaves your family with a clear roadmap, not a frustrating legal puzzle.

Learning how to set up a trust is an act of trust in itself. A recent Accenture Life Trends report found that 62% of people now prioritize trust above all else when dealing with a business. This is especially true in estate planning, where you are placing your family’s future in the hands of your attorney. Choosing a vetted, local Kingwood law firm helps fortify that future against whatever comes next.

Your estate plan is one of the most meaningful gifts you will ever leave your loved ones. At The Law Office of Bryan Fagan, we are dedicated to helping our Kingwood neighbors make it a powerful and lasting one. If you’re ready to get started or just need to review your current plan, schedule a free consultation at our Kingwood office today.

Common Questions About Setting Up a Trust in Kingwood

Even after walking through the steps, it’s completely normal to have a few lingering questions. The world of estate planning has a language all its own, and part of our job is to translate it into plain English so you can move forward with total confidence.

Here are a few of the most common questions we hear from families right here in Kingwood, Humble, and across our corner of Northeast Houston.

How Much Does It Cost to Set Up a Trust in the Kingwood Area?

This is usually the first thing people ask, and the most honest answer is: it really depends. The cost is tied directly to how complex your finances are and what you need the trust to accomplish. A straightforward revocable living trust for a simple estate will be priced differently than, say, an intricate special needs trust designed to protect a vulnerable loved one.

The key is to reframe this from an "expense" to an investment in your family's future. The upfront cost to create a solid trust is almost always just a fraction of the money, time, and heartache your loved ones would face if your estate gets tangled up in the public probate system.

At The Law Office of Bryan Fagan, we're big believers in transparency. We offer a free, no-pressure consultation at our Kingwood office to talk about your goals. We’ll give you a clear, honest breakdown of the costs involved so you can make an informed decision with zero surprises.

Can I Be the Trustee of My Own Living Trust?

Yes, absolutely. In fact, for a revocable living trust in Texas, that's the standard way it's done. When we create your trust, you will almost always name yourself as the initial Trustee.

This setup means nothing changes in your day-to-day life. You maintain complete control over all your assets—you can still buy, sell, invest, and manage your property just like you always have. The magic happens when you also name a Successor Trustee. This is the trusted person or institution you've chosen to step in and manage the trust for you if you become incapacitated or after you're gone, ensuring everything transitions seamlessly and privately.

If I Have a Trust, Do I Still Need a Will?

You do, and this is a critical detail that's easy to miss. A well-crafted, trust-based estate plan always includes a special kind of will known as a pour-over will.

Think of this will as your ultimate safety net. It’s designed specifically to "catch" any assets you might have forgotten to put into the trust or maybe acquired right before you passed away. The pour-over will has one job: to direct those overlooked assets to be transferred—or "poured over"—into your trust. This makes sure every last asset is handled according to the instructions you’ve already laid out, leaving no loose ends for your family to deal with.

How Does a Trust Help My Family Avoid Probate?

This is the big one—the primary reason so many families choose a trust. Probate is the formal, court-supervised process of validating a will and distributing assets. Here in Texas, it can be slow, it can be expensive, and it’s all a matter of public record.

When you fund your assets into a trust, you’re legally changing their ownership. They no longer belong to you personally; they belong to the trust. Because of this, they aren't considered part of your personal estate and fall completely outside the jurisdiction of the Harris County probate courts. Your Successor Trustee can then privately settle your affairs and distribute your assets according to your wishes, saving your family a tremendous amount of money, time, and stress.

Protecting your family’s future is one of the most meaningful actions you can take. If you have more questions or you’re ready to get started, the team at The Law Office of Bryan Fagan – Kingwood TX Lawyers is here to help. We pride ourselves on giving our Kingwood neighbors clear guidance and compassionate support.

Schedule Your Free Consultation at Our Kingwood Office and let's create a plan that brings you true peace of mind.