When you start thinking about your estate plan, it helps to imagine two different paths your assets can take after you're gone. Some assets have a direct route, a sort of 'fast pass' to your loved ones, while others have to take the scenic route through the court system. This fundamental difference between probate and non-probate assets is what determines whether your property transfers quickly and privately or gets tied up in a public, court-supervised process.

For families here in Kingwood, Texas, grasping this distinction is the first and most crucial step toward creating an estate plan that actually works the way you want it to. At The Law Office of Bryan Fagan, we're here to provide that clarity, right here in our community.

Understanding Your Estate Plan in Kingwood

Putting together an estate plan can feel like trying to solve a complex puzzle, especially when legal terms like "probate" get thrown around. At its heart, probate is simply the official process a Texas court uses to make sure everything is handled correctly after someone passes away. The court validates the will, ensures all the final debts are settled, and gives the legal green light to transfer property to the rightful heirs.

For our neighbors in Kingwood, Humble, and across Northeast Houston, the main goal is usually the same: make this time of transition as straightforward and stress-free as possible for family. The good news? Not everything you own has to go through probate. With some thoughtful planning, you can ensure more of your legacy gets to your family quickly, privately, and with far less expense.

The Role of Probate in Texas

Probate isn't inherently bad; it serves a vital purpose by providing a clear, legal framework for wrapping up someone's financial life. It’s the court's way of dotting the i's and crossing the t's, making sure final bills are paid and the right people inherit what they're supposed to.

But that court oversight comes with a price tag. Nationally, the median value of an estate going through probate is about $200,000. The process itself can drag on for 12-18 months and rack up fees that can eat up 5-7% of the estate's total value. These are just a few of the estate planning statistics you can find on sites like wifitalents.com, and they really highlight why knowing which assets can skip this process is so important for Kingwood families.

An effective estate plan is not just about having a will; it's about structuring your assets to align with your family's needs, minimizing delays, and protecting your privacy.

This guide is here to give you that clarity and confidence. We’ll break down exactly what makes an asset a probate or non-probate asset, using simple examples that apply right here in Texas. Our goal is to pull back the curtain on this process, showing you how smart planning today can safeguard your family’s privacy, save them a world of time, and truly preserve the legacy you've built.

At The Law Office of Bryan Fagan, we believe every Kingwood family deserves a clear roadmap for the future. If you're starting to wonder about your own assets and how they're structured, please don't hesitate to reach out. Schedule a free consultation with our local Kingwood team today, and let's get you the answers you need.

What Are Probate Assets Under Texas Law?

When it comes to settling an estate, the first question on everyone's mind is, "What has to go through the court?" In Texas, we call these probate assets.

Think of them as any property owned exclusively in the deceased person's name, with no built-in, automatic instructions for who gets it next. These assets are essentially frozen until a probate judge in Harris or Montgomery County gives the legal go-ahead to transfer them.

This is precisely where a will comes into play. Your will is the instruction manual for the probate court, clearly spelling out how you want these specific assets divided. If you don't have a will, Texas law steps in and makes those decisions for you, and its plan might be very different from your own.

Common Examples of Probate Assets in Kingwood

For most families in Kingwood and the Humble area, probate assets often make up the bulk of their estate. The defining characteristic is always the title—if it's in one person's name and one name only, it’s almost guaranteed to be a probate asset.

Here are a few practical, step-by-step examples you might recognize:

- Real Estate Titled in One Name: The family home in Porter or a piece of land in Northeast Houston where the deed lists only the person who has passed away.

- Individual Bank Accounts: A personal checking or savings account that doesn't have a "Payable on Death" (POD) beneficiary designated.

- Vehicles Titled Solely to the Decedent: A car, truck, or even a boat registered exclusively in the name of the deceased.

- Personal Property: This is a catch-all for all the tangible things—furniture, jewelry, art, and cherished family heirlooms that don't have a formal title document.

- Investment Accounts Without Beneficiaries: A brokerage account with stocks and bonds that’s owned individually and is missing a "Transfer on Death" (TOD) designation.

Because these assets have no direct, legally binding path to a new owner, they fall under the estate's control. The executor, once appointed by the court, is responsible for gathering them, settling any final bills, and distributing what remains to the people named in the will.

Why Is Court Supervision Necessary?

It’s a fair question: why does the court even need to get involved? The probate process was created to be a formal, supervised system that protects everyone with a stake in the estate. It confirms that the will is valid, ensures legitimate creditors are paid, and legally transfers the property to the right heirs.

In essence, probate acts as an official "changing of the guard" for assets that don't have a built-in succession plan. It creates a clear chain of title and prevents future disputes over ownership.

Without this legal framework, transferring something significant like a house would be a nightmare. Can you imagine trying to sell a home in Kingwood that’s still legally owned by someone who has passed away? You simply can't. Probate provides the legal authority needed to sign a new deed and formally pass ownership to the rightful heir, giving the transfer its legal finality.

Navigating the probate court can feel overwhelming, but it's a critical step for these kinds of assets. The team at The Law Office of Bryan Fagan – Kingwood TX Lawyers has years of experience helping local families through this process with efficiency and understanding. If you’re an executor or heir dealing with probate assets, we can help you understand your duties. Schedule a free consultation at our Kingwood office to talk about your specific situation.

Identifying Your Non-Probate Assets

While probate assets get tangled in a formal court process, non-probate assets are all about efficiency. Think of them as having a built-in "fast pass" that lets them go directly to your loved ones, skipping the courthouse entirely. For families here in Kingwood, understanding and using these tools is the secret to a much simpler, more private estate settlement.

This is where proactive planning really shines. By setting up the right ownership structures and beneficiary designations now, you create a direct, automatic path for your property. It ensures your family gets their inheritance without the typical delays and public scrutiny of probate.

Finding the "Fast Pass" Assets in Your Estate

Many folks in Kingwood and Humble already have several non-probate assets and don't even realize it. The magic is all in how an asset is titled or who is named as the beneficiary. These simple instructions are legally binding and actually override whatever your will says about that specific asset.

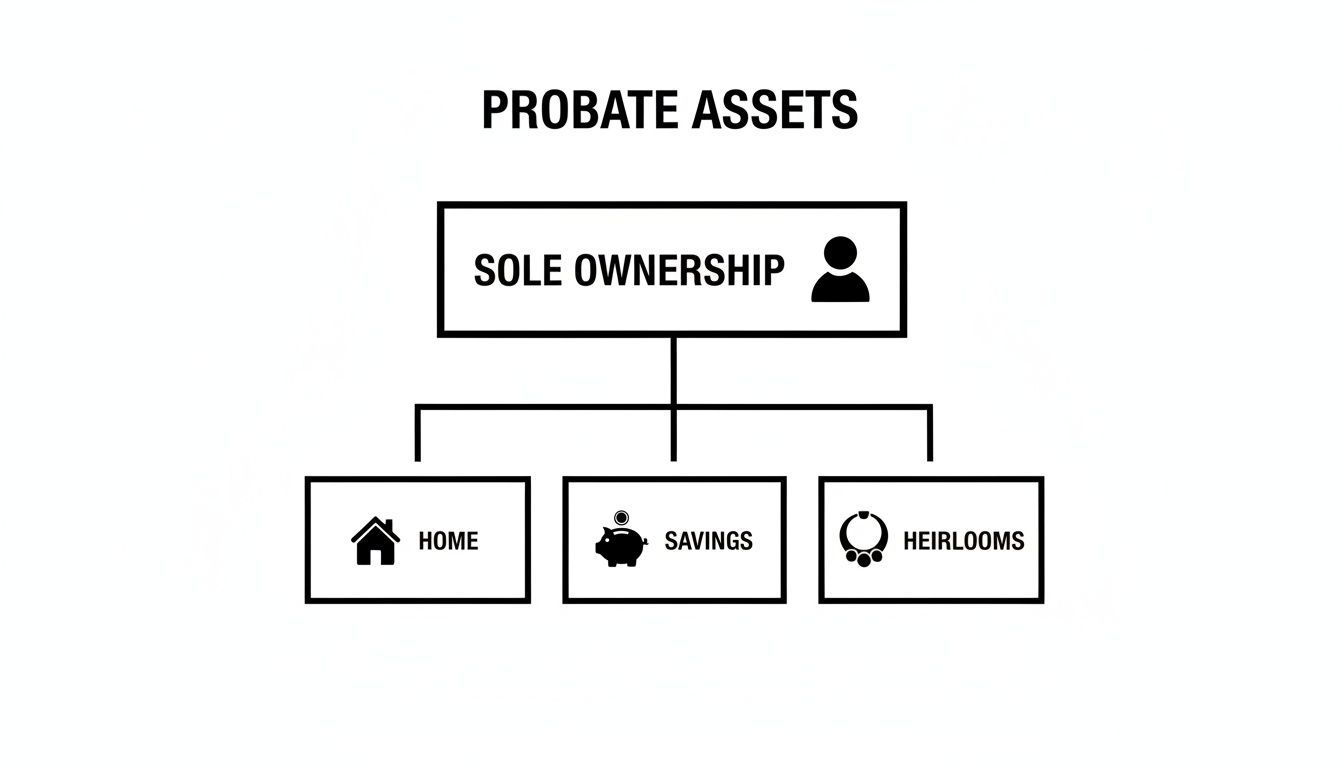

The image below shows the opposite—probate assets—which are stuck in the court system precisely because they are owned by just one person.

As you can see, assets held in a single name need a judge's approval to be transferred. Non-probate assets, on the other hand, come with their own set of instructions.

To help you get a clear picture, let's look at how different assets are typically categorized in a Texas estate.

Probate vs Non-Probate Assets At A Glance

| Asset Type | Typically a Probate Asset (Requires Court) | Typically a Non-Probate Asset (Bypasses Court) |

|---|---|---|

| Real Estate | Property owned solely in the decedent's name. | Property owned as Joint Tenants with Right of Survivorship (JTWROS). |

| Bank Accounts | Checking/savings accounts in the decedent's name only. | Accounts with a Payable on Death (POD) beneficiary; joint accounts. |

| Retirement Plans | Accounts with no beneficiary listed or where the estate is the beneficiary. | 401(k)s, IRAs, or 403(b)s with a designated living beneficiary. |

| Life Insurance | Policies where the estate is named as the beneficiary. | Policies with a designated living beneficiary. |

| Vehicles | Cars, boats, or RVs titled only in the decedent's name. | Vehicles with a Transfer on Death (TOD) registration. |

| Personal Items | Jewelry, art, furniture, and family heirlooms. | (These almost always require probate unless placed in a trust). |

| Investments | Brokerage accounts held in the decedent's name alone. | Accounts with a Transfer on Death (TOD) beneficiary. |

This table gives you a great starting point for taking inventory of your own estate and seeing what might be headed for court.

Common Types of Non-Probate Assets in Texas

Let's break down the most common non-probate tools available to families in Northeast Houston. Chances are, you already have a few of these in place.

Life Insurance Policies: The payout from a life insurance policy goes straight to the beneficiaries you named in the contract. This money is often available to your family fairly quickly, providing critical funds right when they need them most.

Retirement Accounts: Think of your 401(k), IRA, or 403(b). They all have beneficiary designation forms. The money in these accounts passes directly to the people you've listed, avoiding court entirely.

Bank Accounts with POD Designations: You can add a “Payable on Death” (POD) designation to your checking or savings accounts. It's a simple form your bank provides that names a person who can claim the funds with a death certificate, no court order needed.

Investment Accounts with TOD Designations: Just like POD accounts, brokerage and investment accounts can have a “Transfer on Death” (TOD) designation. This allows your stocks, bonds, and mutual funds to transfer automatically to your chosen beneficiary.

Property Owned as Joint Tenants with Right of Survivorship: In Texas, if you own real estate with someone as "Joint Tenants with Right of Survivorship" (JTWROS), your share automatically goes to the surviving owner when you pass away. This is a very common way for married couples to own their Kingwood home.

The Power of Trusts

Maybe the most robust tool for avoiding probate is a Revocable Living Trust. When you create a trust, you’re essentially creating a separate legal entity to hold your assets. You then transfer the title of your property—your Kingwood house, your investment accounts—into the name of the trust.

A trust acts like a private rulebook for your assets. It bypasses the public court system entirely because the trust, not you, owns the property, and it includes clear instructions for what happens after you're gone.

Because the trust provides a complete roadmap for managing and distributing your assets, there's simply no reason for a court to get involved. This strategy doesn't just sidestep probate; it also gives you far more control and privacy. The nuances are important, and you can learn more about the difference between a will and a trust in our detailed guide.

Taking the time to review how your assets are structured can make a world of difference for your family down the road. If you're not sure how your property is titled or want to explore setting up a trust, The Law Office of Bryan Fagan – Kingwood TX Lawyers is here to help. Schedule a free, no-obligation consultation at our Kingwood office, and let's build a plan that secures your legacy and protects the people you love.

Effective Strategies to Avoid Probate in Texas

So, we've covered the difference between assets that go through probate and those that don't. Now for the practical part: how can you set up your estate to keep your family out of the courtroom? For folks here in Kingwood, Humble, and Northeast Houston, there are several fantastic, time-tested strategies to ensure your hard-earned assets pass to your loved ones smoothly and privately.

These aren't secret legal loopholes. They are well-established tools under Texas law designed to give you, not the court, control over your legacy. Using them correctly can save your family a world of hassle, not to mention time and money. The goal is simple: turn as many of your assets as possible into non-probate assets, giving them that direct "fast pass" to your beneficiaries.

The Revocable Living Trust: The Gold Standard for Avoiding Probate

When it comes to avoiding probate, the most powerful and flexible tool is the Revocable Living Trust. Think of a trust as a private container you create to hold your assets. You simply transfer ownership of your property—your Kingwood home, investment accounts, business interests—from your name into the name of the trust.

Don't worry, this doesn't change a thing in your day-to-day life. While you're alive, you're the trustee, meaning you're in complete control. You can manage, sell, or spend the assets just like you always have. The real magic happens when you pass away. Because the trust owns the property, not you, there's nothing for the probate court to get its hands on.

A trust is basically your family's private rulebook for your estate. It completely bypasses the public court system because the property is already held by a legal entity with your clear, written instructions on what to do next.

This approach gives you incredible privacy and control. Unlike a will, which becomes a public document for anyone to read once it's filed with the court, the terms of your trust stay confidential.

It’s a fantastic tool, but it's still surprisingly underutilized. While only about 11% of Americans have a trust, they are a primary way to sidestep probate. The demand for these private solutions is on the rise, with the Trusts & Estates industry now valued at $290.1 billion—a clear sign that people are looking for more efficient ways to handle their affairs.

Beneficiary Designations: A Simple and Powerful Shortcut

Another incredibly effective—and simple—way to avoid probate is by properly using beneficiary designations. Many of your financial accounts already have this feature built-in, allowing you to name a person who gets the asset directly upon your death. No court, no fuss.

- Payable on Death (POD) for Bank Accounts: You can walk into your bank in Kingwood or Humble right now and fill out a quick form to add a POD beneficiary to your checking and savings accounts.

- Transfer on Death (TOD) for Investments: Your brokerage accounts holding stocks, bonds, or mutual funds work the same way. A TOD designation creates a seamless transfer to your chosen heir.

- Retirement Accounts and Life Insurance: By their very nature, these are non-probate assets. The key is to always have both a primary and a contingent (backup) beneficiary named. If you don't, the asset could default back to your estate and get dragged right into probate.

This is critical: you need to review these designations every few years, especially after big life changes like a marriage, divorce, or the birth of a child. An outdated beneficiary name can cause unintended and truly heartbreaking outcomes for your family.

Using Joint Ownership the Smart Way

In Texas, the way you title property with another person makes a huge difference. Owning property as "Joint Tenants with Right of Survivorship" (JTWROS) is a potent probate-avoidance tool, particularly for married couples.

When property is owned with this title, the surviving owner automatically inherits the deceased owner's share. The transfer is instant and happens "by operation of law," meaning it takes place completely outside the probate process. This is how many spouses in the Kingwood area own their homes.

But you have to be careful with this one. Adding a non-spouse, like one of your children, to your deed as a joint owner can open a can of worms. It might expose your home to their creditors or become a sticking point in their future divorce. Before you go down this road, it's vital to talk with a local Kingwood estate planning attorney to fully understand the risks.

Making these strategies work for you is all about proper implementation. For a deeper dive, you can learn more about how to avoid probate in Texas in our detailed guide.

At The Law Office of Bryan Fagan – Kingwood TX Lawyers, we’re dedicated to helping our neighbors in Kingwood and Northeast Houston protect their families and their legacies. If you’re ready to take control of your estate plan, Schedule a free consultation at our Kingwood office today. We'll help you find the right path for your family's unique situation.

How an Executor Manages a Mixed Estate

Being named an executor is a profound expression of trust. It’s an honor, but for many folks in the Kingwood area, that honor quickly turns into a heavy sense of responsibility. This is especially true when you realize the estate isn't simple—it's a mix of probate and non-probate assets.

Your job is to be the estate's manager, which means you'll be wearing two different hats. One requires you to navigate the court system, while the other involves dealing directly with banks and beneficiaries. It can feel like juggling, but with a clear, step-by-step game plan, it's far less intimidating than it sounds.

Step 1: Conduct a Thorough Asset Inventory

First things first, you have to put on your detective hat. Your initial duty as an executor is to find, identify, and create a complete list of everything the deceased owned. For families in Humble and Porter, this is a non-negotiable first step; you can't distribute what you don't know exists.

This inventory needs to be exhaustive. You'll be tracking down documents like:

- Bank and investment statements to get a clear picture of account balances.

- Deeds to real estate to see exactly how the property was owned.

- Vehicle titles for any cars, boats, or RVs.

- Life insurance policies and retirement account paperwork.

- Personal property, which can include anything from jewelry and art to valuable collections.

Once you have this comprehensive list, it's time to sort. You'll need to divide every single item into one of two categories: probate or non-probate. This is where you look for those tell-tale signs, like a POD beneficiary designation or joint ownership with right of survivorship, that signal an asset gets to skip the courthouse.

Step 2: Separate and Manage the Two Asset Paths

With your inventory neatly sorted, you're now managing two distinct workflows. Think of it as two separate projects happening at the same time. Your organizational skills will be key here.

For the non-probate assets, your role is more of a facilitator. The process usually involves:

- Notifying Beneficiaries: Get in touch with the individuals named on the accounts or policies and let them know what they need to do.

- Providing Paperwork: You'll help them by supplying certified copies of the death certificate and any claim forms the financial institution requires.

For the probate assets, however, your journey is just getting started. These assets are now under the court’s supervision. You have no legal right to touch or hand out this property until a judge officially appoints you as the executor. This means you must begin the formal probate process.

As an executor, your legal authority over probate assets only begins once the court issues "Letters Testamentary." This document is your official license to act on behalf of the estate, from paying final bills to distributing property according to the will.

Step 3: Initiating Probate and Distributing Assets

Starting the probate process is a formal legal affair. It kicks off when you file the will and an application with the proper court—for our Kingwood clients, that's typically in Harris or Montgomery County. If you want a deeper dive into this, our guide on how to probate a will in Texas breaks down every step.

After the court officially names you as executor, you’ll manage the probate estate. This involves paying off any final debts and taxes before distributing what's left to the heirs named in the will. Meanwhile, the non-probate assets have likely already been transferred directly to their beneficiaries, often providing much-needed financial support to the family while the court process plays out.

Serving as an executor for a mixed estate is a major undertaking, but you don't have to figure it all out on your own. The Law Office of Bryan Fagan – Kingwood TX Lawyers is here to support you at every turn. Schedule a free consultation at our Kingwood office, and let us give you the guidance you need to fulfill your duties with confidence.

Secure Your Legacy with a Kingwood Estate Planning Lawyer

Taking control of your estate plan is one of the most powerful things you can do for your family. It's about more than just documents; it's about creating a clear path that honors your wishes, protects your privacy, and makes things as easy as possible for the people you love. Getting a handle on the difference between probate and non-probate assets is the first, and most crucial, step.

You don’t have to navigate the complexities of Texas estate law on your own. At The Law Office of Bryan Fagan – Kingwood TX Lawyers, we're not just a law firm; we're your neighbors, deeply committed to serving our community in Kingwood, Porter, and across Northeast Houston. Our goal is to provide clear, compassionate guidance that makes this process feel straightforward, not overwhelming.

Our experienced attorneys can sit down with you and help:

- Go through your current assets and pinpoint exactly what would end up in probate.

- Put smart strategies in place, like trusts or beneficiary designations, to protect your estate from unnecessary complications.

- Make sure your will, property titles, and other critical documents are all correctly prepared and perfectly aligned with your final wishes.

Planning today is an act of love for your family's tomorrow. It provides them with security and peace of mind during a difficult time, ensuring your legacy is preserved exactly as you intended.

Building a solid plan is the best way to secure your family’s future and protect everything you’ve worked so hard to build. Don't leave these vital decisions to chance or in the hands of a court.

Take the first step. We invite you to schedule a free consultation at our Kingwood office. Let’s talk about your goals and build an estate plan that brings both you and your family lasting peace of mind.

Common Questions We Hear About Texas Probate

When it comes to Texas estate law, a lot of questions pop up. To help our friends and neighbors in the Kingwood community get some clarity, we've put together answers to a few of the questions we hear most often about the probate process and what happens to assets.

"Will a Will Keep My Family Out of Probate Court in Texas?"

This is probably the biggest myth we have to bust. It’s completely understandable why people think this, but a will doesn't skip probate—it's actually your ticket into the probate court. Think of it as a set of instructions you're leaving for the judge.

A will is your legally recognized voice telling the court exactly how you want your probate assets divided. If you want to keep certain assets out of the courtroom, you’ll need different tools, like a living trust or beneficiary designations.

"How Long Does the Probate Process Usually Take Around Kingwood?"

The timeline can really be a mixed bag, depending on the estate. Here in Harris or Montgomery County, a straightforward, uncontested probate where everything is in order could wrap up in about six to nine months.

But it’s easy for things to get tangled. If family members contest the will, if there are complicated assets to sort through, or if creditors start making claims, the process can easily stretch out for over a year. The risk of these delays is a huge motivator for many Northeast Houston families to plan ahead and keep as much out of probate as possible.

Key Takeaway: Planning with non-probate assets isn't just about dodging a court date. It's about making sure your loved ones get access to the support you left for them without unnecessary and stressful delays.

"What if I Just Add My Child to My House Deed to Avoid Probate?"

On the surface, this seems like a simple fix. Adding a child to your deed as a joint owner with right of survivorship can make the property a non-probate asset. However, this move is loaded with potential downsides.

Doing this could expose your home to your child's financial problems, like creditors or a divorce settlement. It might also affect their ability to qualify for things like financial aid and could even stir up conflict between your children. It's a classic case of the cure being worse than the disease.

Before you make a move like this, it’s absolutely vital to talk it through with an experienced Kingwood estate planning attorney. We can walk you through the real-world consequences and help you find a strategy that truly protects your family and your assets.

At The Law Office of Bryan Fagan – Kingwood TX Lawyers, we believe every family deserves a clear and effective estate plan. Schedule your free consultation today at https://kingwoodattorneys.com to protect your legacy and provide for your loved ones.