Let's be honest, the term "prenuptial agreement" can sound a little intimidating. Many people in Kingwood hear "prenup" and immediately think of high-stakes celebrity divorces, not their own lives. But that’s a misconception we want to clear up for our neighbors.

The reality is far more practical. A prenup is simply a written agreement you and your partner create before getting married. Think of it less as an exit plan and more like a financial blueprint for your life together. For couples in Kingwood, Humble, and Northeast Houston, it’s a tool for getting on the same page about money, property, and expectations from the very beginning.

What a Prenuptial Agreement Really Means for Kingwood Couples

Here in Texas, we live in a "community property" state. That’s a legal way of saying that most assets and debts you acquire from the day you say "I do" are considered jointly owned. If the marriage ends, a judge divides that community property in a way they see as "just and right."

A prenuptial agreement lets you and your partner create your own rulebook instead of relying on the state’s default one. It allows you to define what will be considered separate property (yours) and what will be community property (ours), giving you control and clarity right out of the gate. At The Law Office of Bryan Fagan, we help Kingwood families tailor the financial side of their marriage to fit their specific circumstances, ensuring fairness and peace of mind.

Why Are More Couples Talking About Prenups?

The stigma around prenuptial agreements is fading fast, especially with younger couples in communities like ours. What used to be a hushed topic is now seen as a sign of smart planning and open communication. And the numbers back this up.

Nationally, about 15% of married couples have a prenup, a massive jump from just 3% in 2010. Millennials, in particular, are driving this trend, recognizing that marriage isn't just a romantic union—it's a serious financial partnership. This shift shows a modern, pragmatic approach to building a strong foundation for the future. You can read more about these evolving trends in marriage planning.

To put it simply, a prenup allows couples to proactively manage their financial future. Here’s a quick breakdown of what these agreements are designed to do.

Prenuptial Agreement Key Functions

| Core Concept | Primary Purpose for Kingwood Clients |

|---|---|

| Asset Designation | Clearly identifies and protects separate property owned before the marriage. |

| Debt Allocation | Assigns responsibility for pre-existing debts to prevent them from becoming a shared burden. |

| Financial Clarity | Establishes clear rules for managing joint finances, property, and future inheritances. |

| Business Protection | Safeguards a local Kingwood business or professional practice from division in a divorce. |

| Spousal Support | Can define or waive rights to future spousal support (alimony), within legal limits. |

Ultimately, these functions work together to create a predictable and mutually agreed-upon financial framework for the marriage.

Building a Stronger Future, Together

At The Law Office of Bryan Fagan, our goal is to take the mystery out of this process for couples in Kingwood, Humble, and across our corner of Texas. We believe that proactive planning can make a partnership stronger by ensuring both people feel secure and respected right from the start.

A well-drafted prenuptial agreement is not about expecting failure; it's about building a partnership on a foundation of transparency and mutual respect for each other's financial well-being.

By tackling sensitive topics like separate property, debt, and inheritances now, you head off potential conflicts down the road. If you're wondering how a prenuptial agreement could bring peace of mind to your upcoming marriage, our team is here to guide you. Schedule a free, no-obligation consultation at our Kingwood office to explore your options.

Practical Reasons Kingwood Couples Get Prenups

Here in our Kingwood community, it's easy to think of prenups as something reserved for celebrities or the super-rich. But the reality is quite different. Our attorneys have seen firsthand how these agreements act as practical, powerful tools for everyday families right here in Northeast Houston. Think of it less as an exit strategy and more as a clear financial blueprint for your marriage, designed to tackle real-world situations before they can ever become problems.

At its heart, a prenup is all about fostering honest communication and smart, proactive planning. It gets partners talking openly about money, property, and their goals for the future. For couples in areas like Humble and Porter, this isn't about expecting the worst; it’s about building a stronger marriage from day one on a foundation of total clarity and mutual respect.

Protecting Your Hard-Earned Assets

One of the most common reasons folks walk into our Kingwood office for a prenup is to protect assets they've poured their sweat and tears into before getting married. This is especially true for local entrepreneurs, dedicated professionals, and anyone who has spent years building a career or a business from the ground up.

Let’s say you own a thriving small business in Kingwood or have been diligently contributing to a retirement account for years. In Texas, without a prenup, those assets could easily get mixed into the community property pot. A prenuptial agreement lets you formally classify those things as your separate property, guaranteeing your individual financial efforts stay yours, no matter what happens down the road. That simple step provides an incredible amount of peace of mind.

Safeguarding Family Legacies and Inheritances

Family means a lot in our community, and that often includes property, businesses, or heirlooms that have been passed down for generations. A prenup is an absolutely crucial tool for protecting these family legacies.

By clearly defining inherited assets as separate property, a prenuptial agreement ensures that a family farm, a cherished lake house, or a stake in a multi-generational business remains within the family line, as intended.

This isn’t just about the monetary value of an asset; it's about honoring your family’s history and wishes. A prenup provides a legally sound way to do this, heading off potential confusion or disputes later on. It also ties directly into your bigger picture, much like the conversations we have during our Kingwood, TX estate planning services, which are all about protecting what you’ve built for the next generation.

Addressing Children from Previous Relationships

When you’re starting a new chapter and have children from a prior relationship, your financial responsibilities naturally become more complex. A well-drafted prenup can bring much-needed clarity and protection for everyone involved.

Many of our Kingwood clients use prenups to:

- Preserve assets for their children: You can legally designate specific assets to be set aside for your children’s inheritance, keeping them completely separate from the new marital estate.

- Clarify child support obligations: While a prenup can't change a court-ordered child support amount, it can specify how those payments are made and from which funds (separate vs. community).

- Protect your new spouse: It can also shield your new partner from being held responsible for pre-existing financial obligations related to your children.

Managing Debt and Financial Responsibilities

A prenup isn’t just about what you own; it's also a powerful tool for managing what you owe. If one partner comes into the marriage with significant student loans, credit card debt, or a business loan, the agreement can spell out that this debt remains their sole responsibility. This protects the other partner from becoming liable for debts they had nothing to do with. By getting this conversation out of the way upfront, couples in Kingwood can sidestep a major source of financial stress and build a more secure future together.

If you think a prenuptial agreement could be a smart move for your upcoming marriage, the dedicated team at The Law Office of Bryan Fagan is here to guide you. Contact our Kingwood office today for a free, confidential consultation to talk through your specific situation.

What a Texas Prenup Can and Cannot Do

When you’re thinking about a prenuptial agreement, it's a bit like laying out the blueprints for your financial future as a couple. It’s a powerful tool, but like any tool, it has specific jobs it’s designed for and others it simply can’t do. For couples here in the Kingwood area, a prenup gives you incredible control over your assets and debts, but Texas law draws some very clear lines in the sand.

Knowing where those lines are is the secret to creating an agreement that actually works—one that will hold up in court if it’s ever needed. Let’s walk through exactly what you can put in a Texas prenup and what you have to leave out.

What a Prenup Can Legally Cover

Think of a prenup as your opportunity to write your own financial rulebook for your marriage. Instead of just defaulting to Texas’s community property laws, you and your partner get to decide what feels fair for your unique situation. This flexibility is what makes it so valuable for our Kingwood clients.

From protecting a family business you've poured your life into to making sure an inheritance is preserved for your kids from a previous marriage, prenups serve very real, practical purposes. Many couples find that simply having these conversations and putting a plan on paper reduces a ton of future stress. You can discover more about the practical functions of prenups from mackrell.com and see how they are viewed as a tool for peace of mind.

Generally, Texas law allows your prenup to:

- Define What’s Yours, Mine, and Ours: You can clearly spell out that certain assets—like the house you owned before getting married or your retirement account—will remain your separate property, no matter what.

- Keep Debts Separate: The agreement can make it clear that one person's pre-existing debts, like student loans or credit card balances, won't become the other's problem.

- Manage Joint Finances: You get to set the rules for how property and income earned during the marriage will be handled, controlled, and divided if you split up.

- Plan for Spousal Support: You can decide ahead of time on the terms of spousal support (alimony), including setting specific limits or even waiving it completely, as long as the terms are fair and one spouse isn't left destitute.

- Direct Life Insurance Payouts: A prenup can name a specific beneficiary for a life insurance policy, which is especially important in blended families.

Taking these steps helps get rid of any gray areas and ensures you both walk into the marriage on the same financial page. It's a proactive move that can save an immense amount of heartache and money if you ever face the Texas divorce process.

What a Prenup Cannot Legally Do

While a prenup is a powerful financial instrument, it doesn’t have unlimited power. The Texas Family Code puts up firm guardrails to protect children and uphold basic public policy.

The single most important limitation is this: a prenup can never dictate child custody or child support. A judge will always make those decisions based on what’s in the “best interest of the child” at that moment in time.

Life changes. A child's needs evolve. What seems fair today might be completely inappropriate in five or ten years. That's why a Texas court will always keep the authority to make decisions about children, regardless of what a document signed years ago might say.

To make this crystal clear for our clients in Kingwood and Northeast Houston, here’s a simple breakdown of what’s on and off the table.

Permissible vs Prohibited Clauses in a Texas Prenup

| What You CAN Include | What You CANNOT Include |

|---|---|

| How to classify property as separate or community. | Decisions about child custody or visitation schedules. |

| Who is responsible for pre-marital debts. | Pre-determined child support payments (either setting or waiving them). |

| Agreements about spousal support or alimony. | Clauses that violate public policy, such as encouraging divorce. |

| Management of business assets and income. | Provisions that are fraudulent or intended to deceive creditors. |

| Designation of life insurance policy beneficiaries. | Anything that is criminally illegal. |

Getting these distinctions right is absolutely critical. If you try to include a prohibited clause, a court will likely throw it out. In a worst-case scenario, it could even put the validity of your entire agreement at risk.

If you’re considering a prenuptial agreement, it’s vital to work with a family law attorney who lives and breathes these Texas-specific rules. The team at The Law Office of Bryan Fagan in Kingwood is here to offer clear, practical guidance. Schedule a free consultation with us today to discuss how we can help you build a strong, effective, and legally sound agreement that protects your future.

How to Create a Legally Binding Texas Prenup

An unenforceable prenuptial agreement isn't worth the paper it's printed on. To make sure the document you create offers real, lasting protection, it has to meet the specific legal standards laid out by Texas law. Think of it like a recipe: if you miss one of the key ingredients, the whole thing can fall apart.

For our clients here in Kingwood and the surrounding communities, our goal is always to build a rock-solid agreement that will hold up in court if it ever needs to. That means we have to carefully navigate the requirements of the Texas Family Code to craft a document that is fair, transparent, and built to last.

The Foundation: Full and Fair Disclosure

The absolute cornerstone of any valid Texas prenup is full and fair financial disclosure. Before anyone signs on the dotted line, both partners must lay all their financial cards on the table. This means everything—every asset, debt, source of income, and piece of property.

Trying to hide an asset or lowball the value of a business isn't just a bad way to start a marriage; it's legal grounds for a judge to toss out the entire agreement down the road. Real transparency builds trust and guarantees both of you are making fully informed decisions, which is exactly what Texas courts want to see.

Voluntary Agreement, Free From Duress

Another non-negotiable element is that the agreement must be signed voluntarily. In plain English, this means nobody was forced, threatened, or manipulated into signing. A Texas judge will look very closely at the circumstances surrounding the signing.

For instance, handing your fiancé a prenup on the courthouse steps moments before you say "I do" is a huge red flag for what the law calls duress. This is precisely why we urge our Kingwood clients to start the prenup conversation months, not days, before the wedding. A generous timeline allows for calm, thoughtful discussion and removes any hint of last-minute pressure.

A prenuptial agreement signed under pressure or without full understanding isn't a valid contract—it's a potential legal battle waiting to happen. The goal is to create a document that reflects a true meeting of the minds.

The Importance of Independent Legal Counsel

While it’s not technically a strict legal requirement in Texas, it is highly advisable for each partner to have their own attorney. It’s a classic conflict of interest for one lawyer to try and represent both sides.

Having separate attorneys ensures both of you get advice tailored to your unique financial interests and that your rights are fully protected. A judge in Northeast Houston is far more likely to see an agreement as fair and enforceable when it’s obvious both parties had professional representation guiding them through the process.

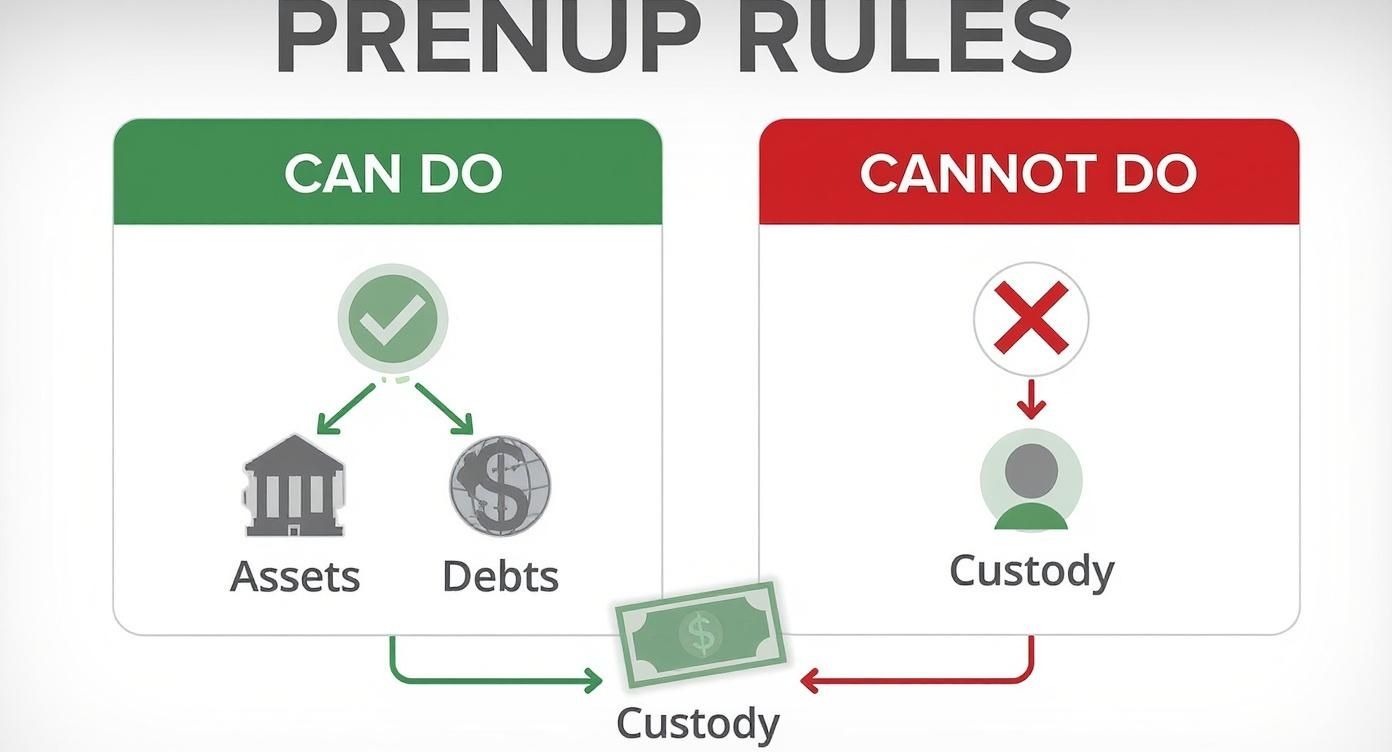

This infographic gives a quick visual rundown of the core rules for what a prenup can and can't cover, helping to draw those legal lines in the sand.

This distinction is important because it highlights why the agreement must stick to financial matters and leave any decisions about children to the courts, where they belong.

Avoiding an Unconscionable Agreement

Finally, a Texas court can throw out a prenup if its terms are deemed unconscionable. This is a high legal bar to clear, but it essentially means the agreement is so shockingly one-sided that it would be fundamentally unfair to enforce it. This usually only happens when there’s a combination of factors, like an agreement based on fraud or signed under duress where one spouse also didn't get proper financial disclosure.

Interestingly, while prenups are becoming more common for couples from all walks of life, there are still some noticeable trends. Research shows men initiate the conversation about 82% of the time. That said, this is shifting as more women become primary breadwinners and want to protect their own hard-earned assets. You can learn more about trends in prenup negotiations and see how these dynamics are changing.

By sticking to these core principles—honesty, voluntariness, independent legal advice, and fundamental fairness—you can create a prenup that provides genuine peace of mind.

Drafting a prenup that will stand the test of time requires careful attention to detail and a deep understanding of Texas law. If you're in Kingwood, Humble, or Porter and thinking about a prenuptial agreement, don’t leave it to chance. Contact The Law Office of Bryan Fagan for a free, confidential consultation to ensure your agreement is built on a solid legal foundation.

The Prenup Process with a Kingwood Family Lawyer

Starting the conversation about a prenuptial agreement can be the most intimidating part. Once you get past that, understanding how it all comes together makes the process feel much more grounded and less overwhelming. Here at The Law Office of Bryan Fagan, we've refined a supportive, step-by-step approach for our Kingwood-area clients. Our entire focus is on making the experience clear, collaborative, and anything but confrontational.

We’ve found that the process itself can actually encourage open communication, ensuring both you and your partner feel heard and respected. A prenup built on a foundation of total transparency isn't just a legal document—it's a tool that can strengthen a partnership right from the start.

Step 1: Your Initial Consultation

It all starts with a free, confidential consultation at our Kingwood office. This is simply a conversation, not a commitment. It's your chance to ask every question on your mind and for us to get a feel for your unique situation. We'll talk about your goals, your financial landscape, and what you both hope to accomplish with an agreement.

This first meeting is really about setting the stage. We can explain how Texas law applies directly to your circumstances and map out a clear path forward, so you’ll leave with a solid understanding of what comes next.

Step 2: Gathering Financial Information

As we mentioned earlier, full and fair financial disclosure is the absolute bedrock of a valid Texas prenup. So, the next practical step is for you and your partner to gather all the relevant financial documents. This means pulling together things like:

- Statements from bank accounts, investments, and retirement funds

- Deeds for any real estate you own

- Details on any business interests or ownership stakes

- A list of significant personal property (art, jewelry, vehicles)

- Paperwork for any debts, from student loans to mortgages

Honesty and thoroughness here are non-negotiable. Complete transparency ensures the final agreement is built on accurate information, which makes it legally sound and, just as importantly, fair to both of you.

Step 3: Drafting and Negotiation

With all the financial details on the table, our team will draft the first version of the prenuptial agreement. This initial draft is custom-built to reflect the specific goals and terms you discussed in our consultation. Think of it as the starting point for a collaborative review.

This is where having separate, independent lawyers really shows its value. Your partner’s attorney will review the draft, and then our two legal teams will work together to refine the terms. This is not an adversarial fight; it's a professional negotiation designed to produce a final document that both partners feel good about and completely understand.

The negotiation phase is a structured dialogue, not a battle. It’s about fine-tuning the details to create an agreement that protects both individuals while honoring the partnership.

Step 4: Finalizing the Agreement

Once every term has been discussed and agreed upon, we prepare the final prenuptial agreement for you to sign. We can't stress this enough: you should aim to start this process at least three to six months before your wedding date. This timeline is critical because it eliminates any possible claim of duress or last-minute pressure, which are two of the main things that can be used to challenge a prenup down the road.

Giving yourselves ample time for thoughtful review and discussion ensures the agreement is a true reflection of your shared decisions. This clear, supportive process is a cornerstone of our Kingwood family law services and provides genuine peace of mind as you prepare to start your new life together.

Answering Your Kingwood Prenuptial Agreement Questions

Even after you understand the basics, it's completely normal to have more specific questions about what a prenup really means for your future together. These are big conversations, and getting straight answers is the first step to feeling confident about your decision. Here are some of the most common questions we hear from clients right here in our Kingwood office.

How Much Does a Prenup Actually Cost Around Here?

This is usually the first thing people ask, and the honest-to-goodness answer is: it really depends. The cost of a prenuptial agreement is tied directly to how complex your financial picture is. An agreement for a young couple with fairly straightforward assets is going to be a lot more affordable than one for partners who own businesses, have family trusts, or hold complicated investment portfolios.

The main things that affect the cost are the hours needed for financial disclosure, drafting the document, and any back-and-forth negotiations. Here at The Law Office of Bryan Fagan, we're all about being upfront. We'll give you a clear cost estimate during your free consultation, so there are no surprises and you can make a sound financial decision from day one.

What if My Partner Shuts Down When I Mention a Prenup?

This is a tough spot to be in, but it’s more common than you think. Bringing up a prenup can sometimes feel like you're planning for failure, but it’s all about how you frame it. We always advise our Kingwood clients to approach this conversation as a team.

Instead of it being a "just in case" plan, talk about it as a smart financial move for your marriage. It's about laying all your cards on the table and starting your life together with complete honesty and a shared financial game plan. If the conversation still feels stuck, bringing in a neutral third party can work wonders. A meeting with an experienced family law attorney provides a calm, professional setting to talk through the benefits for both of you, which often takes the emotional sting out of it.

Is a Prenup Worth it if We Don't Have Much Right Now?

Absolutely. For a lot of the young professionals, entrepreneurs, and new families we see in Humble and Porter, this is one of the biggest reasons to get a prenup. An agreement isn't just about the assets you have in the bank today; it's about looking ahead. A good prenup can proactively address:

- Future Paychecks: How will the money you earn during the marriage be handled?

- A Growing Business: What happens with a business one of you starts or grows?

- Potential Inheritances: How will you protect family money or property you might receive down the road?

- Future Debt: How will you manage any new loans or financial responsibilities?

Think of it as a financial roadmap for your marriage. It ensures that as your careers take off and your assets grow, you already have a plan in place, preventing major disagreements later.

Can We Change the Prenup After We're Married?

Yes, you can. A prenup isn't carved in stone. As your life evolves, your financial agreement can, too. Texas law allows you to amend (change) or even revoke (cancel) a prenuptial agreement after you've tied the knot.

But there's a catch. Any changes have to be done through a formal, written agreement that both of you sign willingly. This new document, which is often called a postnuptial agreement, comes with its own strict legal rules to be valid. It's crucial to work with an attorney to make sure any updates are done correctly and will hold up in court.

The fact is, prenups are becoming much more common because people now see marriage as both a romantic and a financial partnership. Today, somewhere between 15-20% of marriages start with a prenuptial agreement, and that number is climbing. A 2022 survey showed that while 15% of all married couples had a prenup, over half of those people had been married before, which just goes to show how practical they can be for blended families. Discover more insights about why couples are considering prenups in 2025. This trend is all about couples being proactive and wanting to build a marriage on a foundation of financial clarity.

At The Law Office of Bryan Fagan – Kingwood TX Lawyers, we get that talking about a prenup is personal and can feel overwhelming. Our experienced attorneys are here to offer compassionate, clear-headed guidance to help you and your partner build a plan that protects you both and strengthens your future. If you live in Kingwood, Humble, or anywhere in Northeast Houston, reach out to us today. We can schedule a free, confidential consultation to help you take that first step toward a secure foundation for your marriage.