When you're thinking about estate planning, the real difference between a revocable and irrevocable trust boils down to a single, crucial element: control. Think of a revocable trust as a flexible financial blueprint—you can erase lines, move walls, or tear it up and start over whenever you want. An irrevocable trust, on the other hand, is like pouring a permanent foundation. Once it's set, it's incredibly difficult to change.

For our neighbors in Kingwood, this choice has a ripple effect on everything, from protecting your hard-earned assets to securing your family's future. The team at The Law Office of Bryan Fagan is here to provide the practical legal advice you need to make the right decision.

Understanding Your Texas Trust Options

When it comes to planning for your family’s future in Kingwood, Humble, or anywhere in Northeast Houston, a trust is one of the most powerful tools in your arsenal. It’s a legal arrangement where you, the creator (or "grantor"), transfer assets to someone you trust (the "trustee") to manage for the people you care about (your "beneficiaries"). But not all trusts are built the same. Under Texas law, the biggest divide is between those that are revocable and those that are irrevocable.

Getting this initial structure right is absolutely the most critical step in building a solid estate plan.

Why? Because this one decision directly impacts:

- Your freedom to modify the trust as life changes.

- How well your assets are shielded from potential creditors right here in Texas.

- The tax implications for your estate down the road.

- Your ability to qualify for long-term care benefits like Medicaid.

To give our Kingwood neighbors a clear picture from the get-go, we've put together a high-level comparison. Consider this a starting point for a more detailed conversation about your specific goals. Our team of dedicated Kingwood estate planning attorneys is here to help you navigate the finer points with professional, empathetic guidance.

Revocable vs Irrevocable Trust At a Glance for Texas Residents

Here’s a quick-glance table that cuts through the legal jargon and lays out the core differences between these two types of trusts for Texas residents.

| Feature | Revocable Trust | Irrevocable Trust |

|---|---|---|

| Flexibility to Change | High. You can amend, change beneficiaries, or even dissolve the trust. | Low. Cannot be easily changed or terminated once it's created. |

| Control Over Assets | Full Control. You're still in the driver's seat with your assets. | No Control. You give up control and ownership to the trustee. |

| Probate Avoidance | Yes. Assets in the trust bypass the public Texas probate process. | Yes. Assets are outside your estate, so they also avoid probate. |

| Asset Protection | None. Creditors can still reach the assets because they are legally yours. | High. Assets are generally protected from your personal creditors. |

| Estate Tax Reduction | No. Assets are still part of your taxable estate. | Yes. Assets are removed from your estate, potentially reducing estate taxes. |

While this table gives you a basic framework, the right choice is never one-size-fits-all. It hinges entirely on your personal situation and what you want to accomplish. Making the right decision now is the key to ensuring your legacy is protected exactly as you envision it.

The Revocable Living Trust: A Flexible Tool for Texas Families

For many families we work with here in Kingwood, Humble, and across Northeast Houston, the revocable living trust is often the go-to estate planning tool. Its main draw is pretty simple: it gives you total control and flexibility over your assets while you're alive, making it a fantastic solution for life's inevitable curveballs.

It helps to think of a revocable trust as an empty box you create to hold your most important things—your home in Kingwood, your investment accounts, maybe a family business in Porter. You then transfer the legal title of these assets into the trust. But here’s the crucial part: you are still in full command.

As the creator (grantor) and typically the manager (trustee), you can do whatever you want with the assets—sell them, spend them, manage them—just like you did before. If your situation changes, say you sell your Kingwood property or want to change who gets what, you can amend or even completely get rid of the trust. No one else's permission is needed.

Bypassing the Texas Probate Process

One of the single biggest advantages of a revocable trust for Texas families is its ability to sidestep probate. When you pass away with only a will, your estate has to go through a public, often slow, and sometimes expensive court process in Montgomery or Harris County. This can tie up assets for months, leaving your loved ones in limbo.

Assets held inside a revocable trust, however, aren't part of your probate estate. When you pass, the successor trustee you named—maybe a responsible adult child or a trusted professional—steps in. They manage and distribute your assets exactly as you laid out in the trust document, all without needing to go to court.

This process not only avoids the public record of probate, keeping your family’s finances private, but it also ensures a much quicker and smoother transfer of your legacy to your heirs.

This practical step-by-step function has made revocable trusts a cornerstone of modern estate planning for Kingwood residents. The flexibility to modify or even cancel the trust at any time is a key feature that separates it from other types of trusts and has cemented its popularity for avoiding the probate system.

Understanding the Limitations

While that flexibility is a huge plus, it’s also the source of the trust's limitations. Because you never truly give up control over the assets, Texas law still views them as yours for most other purposes.

Here’s what that means in practice:

- No Creditor Protection: Since you can take assets out of the trust whenever you want, they aren't shielded from your personal creditors or lawsuits. If you're hit with a legal judgment, assets in your revocable trust can be used to pay that debt.

- No Estate Tax Benefits: For the same reason, everything inside a revocable trust is still counted as part of your taxable estate. This kind of trust won't help you reduce potential federal estate tax liability if you have a high-net-worth estate.

- Medicaid Ineligibility: The assets are also considered "countable" for Medicaid eligibility. A revocable trust won’t help you qualify for long-term care benefits down the road.

At The Law Office of Bryan Fagan, we guide Kingwood families through the practical power and the real-world boundaries of wills and trusts. A revocable trust is an excellent tool for avoiding probate and managing your affairs, but it's just not built for asset protection or serious tax reduction.

Choosing this path is about prioritizing flexibility and an easy transition for your family. If your main goal is to make sure your children receive their inheritance without the delays and public nature of probate court, a revocable trust is often the perfect fit. To figure out if this flexible tool is right for your family's needs, contact our Kingwood office to Schedule a free consultation.

The Irrevocable Trust: A Powerful Shield for Your Assets

While a revocable trust gives you flexibility, some situations call for something much stronger. For certain Kingwood families and professionals, the irrevocable trust acts as a fortress, offering a level of security that a more flexible trust simply can't. It’s a strategic move when the primary goals are serious asset protection or significant tax planning.

The core idea behind an irrevocable trust is simple: when you transfer assets into it, you are legally giving up ownership and control. Those assets—whether it's real estate in Northeast Houston or a hefty investment account—now belong to the trust itself, managed by a trustee you've appointed.

This permanent transfer is precisely where the trust gets its power. Because the assets are no longer legally yours, they're put out of reach in ways a revocable trust can never accomplish. It’s a major trade-off, no question. You give up control, but what you gain is a formidable defense for your legacy.

Gaining Robust Asset Protection

For many professionals in our community, the risk of a lawsuit is a constant, nagging concern. A physician in Kingwood, a small business owner in Humble, or a real estate developer in Porter could all face litigation that threatens their personal wealth. This is where an irrevocable trust truly shines.

By moving assets into an irrevocable trust, you essentially build a firewall between your personal finances and potential legal claims. If a lawsuit ever comes your way, the assets held inside that trust are generally shielded from creditors and legal judgments under Texas law.

An irrevocable trust isn't just an estate planning tool; it's a proactive defense strategy. It separates your legacy assets from your professional liabilities, ensuring that a lawsuit against your business doesn't jeopardize your family’s financial future.

This level of protection is a critical consideration for anyone in a high-liability profession. It's how you ensure the wealth you've worked so hard to build is preserved for your beneficiaries, no matter what legal challenges may arise down the road.

Strategic Estate Tax Mitigation

For high-net-worth individuals and families in Northeast Houston, minimizing estate taxes is often a top priority. The federal estate tax can take a huge bite out of an estate's value, but an irrevocable trust provides an effective solution.

Because the assets you place in the trust are removed from your personal ownership, they are also removed from your taxable estate. This move can dramatically lower, or even eliminate, your estate tax liability, allowing more of your wealth to pass directly to your heirs.

- Taxable Estate Reduction: When you transfer assets like stocks, real estate, or life insurance policies into the trust, you shrink the overall value of your estate that's subject to tax when you pass away.

- Preserving Your Legacy: This strategy makes sure the value of your assets goes to your beneficiaries instead of the government, preserving the full strength of your financial legacy.

While revocable trusts do not protect assets from estate or income taxes—because the grantor keeps control—irrevocable trusts hand ownership over to a trustee. This removes the assets from the taxable estate and, in many cases, shields them from creditor claims. This protection is particularly valuable to professions facing higher litigation risks, like doctors, lawyers, and real estate developers. You can find more insights about the differences between trusts on FreeWill.com.

Deciding to create an irrevocable trust is a major step that requires careful thought. At The Law Office of Bryan Fagan, we help our Kingwood clients weigh the benefits of ultimate protection against the trade-off of giving up control. Schedule a free consultation at our local office to determine if this powerful shield is the right strategy for you.

Comparing the Core Differences for Kingwood Residents

Choosing between a revocable and an irrevocable trust isn't just about legal jargon; it's a practical decision that will shape your family's future. For our neighbors here in Kingwood, Humble, and across Northeast Houston, understanding the real-world trade-offs is what really matters. Let's break down the most important distinctions, piece by piece, to give you a clear framework for your decision.

Each option comes with its own set of advantages and limitations under Texas law. The right path for you depends entirely on what you want to accomplish with your estate plan.

Flexibility and Your Control Over Assets

The most immediate difference you'll feel is the level of control you keep over your money and property. This single factor dictates how you can interact with your assets once they're in the trust.

With a revocable trust, you are always in the driver's seat. You can change beneficiaries, sell a house owned by the trust, or even pull the plug on the whole thing if your life circumstances change. Think of it as a detailed plan written in pencil—you can erase and rewrite it whenever you need to.

An irrevocable trust is the complete opposite. Once you transfer assets into it, you have legally given up your right to control them or change the trust's terms. It’s a permanent decision, like a contract etched in stone. Making any changes is incredibly difficult and usually requires getting a court involved, which is why people only choose this path for very specific, high-stakes goals.

Asset Protection from Creditors and Lawsuits

For many professionals and business owners in Kingwood, protecting personal wealth from potential legal action is a top priority. This is where the two trusts couldn't be more different.

A revocable trust offers precisely zero protection from your personal creditors or lawsuits. Because you maintain full control and can pull assets out at any time, Texas law sees those assets as your own. If you face a legal judgment, everything in your revocable trust is fair game.

On the other hand, an irrevocable trust provides powerful asset protection. Since you no longer legally own the assets inside it, they are generally shielded from your personal creditors and legal claims. This creates a strong financial wall between your personal liabilities and the legacy you've built for your family.

The core trade-off is simple: A revocable trust gives you control but no protection, while an irrevocable trust gives you protection but no control. This is the central pivot point for most families' decisions.

Understanding this distinction is crucial for anyone in a high-liability profession or anyone just plain worried about future financial risks.

Impact on Estate Taxes and Your Legacy

For families with significant wealth, estate tax planning is a critical piece of the puzzle. The way a trust is structured has a direct impact on whether your estate will owe federal estate taxes.

Assets held inside a revocable trust are still considered part of your taxable estate. This type of trust does nothing to reduce your potential estate tax bill. Its main job is to avoid probate, not to minimize taxes for high-net-worth individuals.

An irrevocable trust, however, is a key tool for slashing estate taxes. When you move assets into the trust, you remove them from your taxable estate for good. This can significantly lower or even eliminate the estate taxes your family might otherwise have to pay, ensuring more of your wealth actually gets to your beneficiaries.

Planning for Long-Term Care and Medicaid

The skyrocketing cost of long-term care is a major worry for many families in the Porter and Northeast Houston area. Planning ahead can determine whether you qualify for government help like Medicaid to cover those huge expenses.

A revocable trust won't help you with Medicaid planning. The assets within it are considered "countable," which means they will almost certainly disqualify you from receiving benefits. You would be forced to spend down those assets before you could become eligible.

An irrevocable trust is a cornerstone of smart Medicaid planning. By transferring assets into a properly designed irrevocable trust well in advance (because of Medicaid's "look-back" period), those assets are no longer counted for eligibility purposes. This strategy allows you to qualify for benefits without draining your life savings, preserving your legacy for your loved ones.

The Process of Administration and Cost

Finally, let's look at the practical side of setting up and managing these trusts.

- Revocable Trust Administration: During your lifetime, you typically act as your own trustee, so managing it is straightforward. The setup costs are also generally lower because the legal structure is less complex.

- Irrevocable Trust Administration: This trust requires someone else—a separate trustee—to manage the assets. The setup is more intricate to make sure it provides the intended protection, which often means higher initial legal fees.

While a revocable trust is less expensive upfront, the real value of an irrevocable trust is in its long-term protective power. For the right situation, that initial investment buys invaluable peace of mind and financial security.

Navigating these differences can feel overwhelming, but you don't have to figure it out alone. The Law Office of Bryan Fagan is here to help our Kingwood neighbors understand their options. Schedule a free, no-obligation consultation at our local office to discuss your family's unique needs and build an estate plan that truly protects your future.

Which Trust Is Right for You? Let's Look at Real-World Scenarios

Understanding the textbook definitions of revocable and irrevocable trusts is one thing. Seeing how they work for real families right here in our Kingwood community is where it all starts to click. To help you connect these ideas to your own situation, let's walk through a few practical examples we often see with our clients.

Every family's story is different. The estate plan that works for your neighbor in Humble might not be the right fit for you in Porter. It always comes down to what you're trying to accomplish.

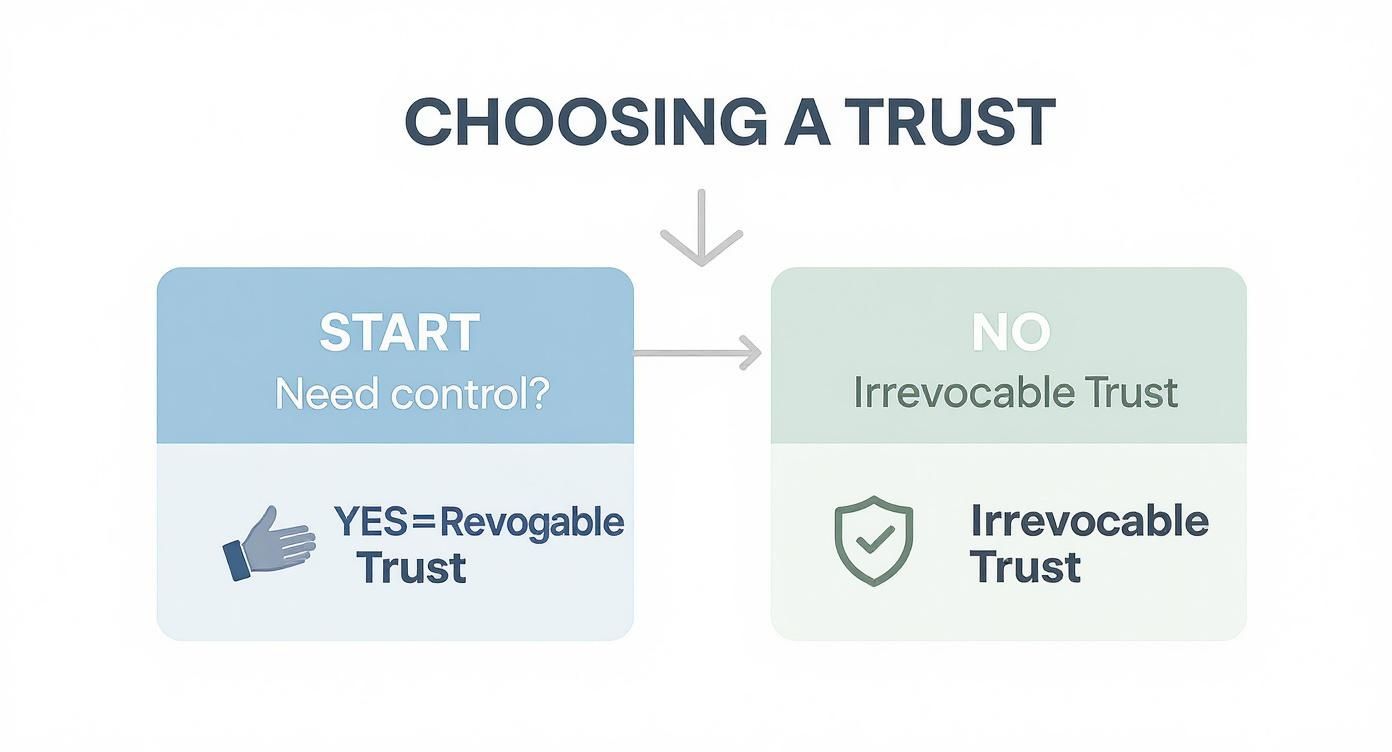

This simple decision tree is a great starting point to see which path aligns with your main goals.

As you can see, the fundamental question boils down to control versus protection. Your answer to that one question will point you toward the trust structure that best serves your primary objective.

Scenario 1: The Young Family in Humble Focused on Avoiding Probate

Let's picture a young couple in their late 30s with two small children. They just bought a home in Humble, and their main worries are pretty straightforward: they want to keep their estate out of the public, often lengthy, Texas probate court system. Most importantly, they need to name guardians for their kids if the unthinkable happens.

Their net worth is growing, but they aren't near the threshold for estate tax concerns. They also don't work in high-risk professions, so aggressive creditor protection isn't their top priority right now. They simply need a plan that’s easy to manage and can evolve with them.

Recommendation: For this couple, a revocable living trust is almost always the perfect fit.

- Probate Avoidance: It ensures their home and other assets pass directly to their children (or are managed for them) without getting tied up in court.

- Flexibility: As they have more children, buy a new house, or open new investment accounts, they can easily update the trust themselves.

- Control: They keep complete control over their assets, managing them exactly as they do today.

A revocable trust delivers the efficiency and peace of mind they’re looking for without the permanence of an irrevocable trust.

Scenario 2: The Porter Business Owner Who Needs Asset Protection

Now, think about a successful business owner in Porter who has poured decades into building their company. They have significant personal wealth—including investment properties across Northeast Houston—that is completely separate from the business. Their biggest fear is a lawsuit against the business spilling over and wiping out the nest egg they've built for their family.

Their primary goal isn’t flexibility; it’s about building a financial fortress. They are willing to give up direct control over some assets in exchange for the strongest protection possible from creditors and legal judgments.

Recommendation: An irrevocable trust is the clear choice here.

- Creditor Shield: By transferring their non-business real estate into an irrevocable trust, they legally sever their ownership. Those assets are no longer on the table in a lawsuit against them or their business.

- Estate Tax Reduction: As a high-net-worth individual, moving assets out of their direct estate now also provides powerful estate tax benefits down the road.

For this business owner, giving up direct control is a calculated trade-off. The security gained by shielding their legacy from professional risk far outweighs the inability to amend the trust later.

Scenario 3: The Kingwood Retiree Planning for Long-Term Care

Finally, let’s consider a retiree in their early 70s living in Kingwood. They own their home outright and have a comfortable, but not unlimited, nest egg. Their biggest worry is the staggering cost of nursing home care, which they know could exhaust their life savings and leave nothing for their children. They want to plan ahead to qualify for Medicaid, if necessary, without having to spend down everything they’ve worked a lifetime to build.

Recommendation: A specialized irrevocable trust, often called a Medicaid Protection Trust, is the strategic tool for this situation.

- Medicaid Eligibility: Assets moved into this trust are not considered "countable" for Medicaid eligibility after a five-year look-back period has passed.

- Legacy Preservation: This strategy allows them to qualify for assistance while ensuring their home and savings are preserved for their heirs, exactly as intended.

These scenarios show that the "revocable vs. irrevocable trust" debate isn’t about which one is "better"—it's about which one is better for you. The right choice is the one that directly solves your biggest problems and aligns with your priorities.

At The Law Office of Bryan Fagan, we specialize in helping Kingwood families find that perfect fit. We invite you to schedule a free consultation at our Kingwood office to talk through your personal scenario and build a plan that gives you true confidence in your family's future.

Revocable vs Irrevocable Trusts in Texas: Control, Benefits & Risks

Choosing the right trust isn't just a legal task; it's one of the most important decisions you'll make to protect your family's future. We've walked through the major differences between revocable and irrevocable trusts, but the truth is, the "right" choice always comes down to your specific goals, your financial picture, and your family's needs right here in Kingwood.

There’s simply no one-size-fits-all answer in estate planning. Trying to navigate this alone with a template from the internet can unfortunately create serious problems down the road for the very people you’re trying to protect. A solid estate plan is a personalized strategy, not just a document.

Your Kingwood Neighbors in Estate Planning

As a local Kingwood law firm, we live and work alongside our clients in Humble, Porter, and throughout Northeast Houston. We're part of this community, which means we understand the unique concerns and goals of Texas families like yours. Our job is to cut through the legal jargon and give you a clear, straightforward path.

Making a thoughtful choice between a revocable and irrevocable trust today is one of the most meaningful actions you can take to provide for and protect your family tomorrow.

Ultimately, this is about more than just who gets what. It’s about securing peace of mind. It’s about making sure your wishes are respected and that your family is spared from the stress and public nature of probate court. A well-crafted plan ensures a smooth transition and protects the assets you've spent a lifetime building.

Every family deserves a plan that lets them feel secure. We invite you to come in and talk with us. Let’s sit down and figure out what makes the most sense for you.

You can schedule a complimentary, no-obligation consultation at our Kingwood office to discuss your situation. Let's build a plan that truly protects what matters most. Book your free meeting with our experienced team by visiting our contact page today.

Your Texas Trust Questions, Answered

When it comes to trusts, a lot of questions come up. It's completely normal. As a law firm rooted right here in Kingwood, we've heard just about all of them from our neighbors in Humble, Porter, and across Northeast Houston. Here are some straightforward answers to the questions we hear most often.

Can I Switch a Revocable Trust to an Irrevocable One?

Yes, Texas law generally allows you to amend a revocable trust to make it irrevocable. Think of it as flipping a switch from "flexible" to "permanent." It’s a major legal move that locks in the trust's terms and removes your direct control over the assets inside.

Going the other way, however, is a different story. Once a trust is irrevocable, you can't just change it back. This is why it’s so critical to have a serious conversation with an experienced Kingwood estate planning attorney before making that change—you need to be absolutely certain it fits your long-term vision.

What’s the Cost to Set Up a Trust in Kingwood?

The cost really depends on what you need the trust to do. A standard revocable living trust is typically more straightforward and, therefore, less expensive than a complex irrevocable trust built for highly specific goals like asset protection or advanced tax planning.

Investing in a properly drafted trust now is a proactive step that can save your family from significant future expenses, legal hurdles, and unnecessary stress.

We believe in total transparency at our Kingwood office. We lay out all the costs during a free consultation, so you’ll know exactly what to expect from the start. No surprises, just clear information.

What Happens to the Assets in My Trust After I Die?

This is where your planning really pays off. When you pass away, the successor trustee you named steps in to manage the trust according to your instructions. Their job is to make sure your wishes are carried out precisely as you wrote them.

- With a revocable trust, the trustee’s main job is to distribute the assets to your beneficiaries, completely avoiding the public and often time-consuming probate process.

- With an irrevocable trust, the trustee continues to manage and distribute the assets over time, following the specific rules you established when you created it.

Either way, a well-crafted trust provides a private and efficient way to pass your legacy to the people you care about most.

At The Law Office of Bryan Fagan – Kingwood TX Lawyers, we're here to give our Kingwood neighbors the clear, practical guidance they deserve. Schedule your free consultation today at https://kingwoodattorneys.com.