When someone passes away in Texas without a will, the state doesn't get to decide what happens to their property on a whim. Instead, a specific set of laws called intestate succession kicks in to determine who inherits the assets. For families in Kingwood and the surrounding communities, understanding this process can provide a clear path forward during a challenging time. It's a legal roadmap designed to distribute an estate based on family relationships.

What Happens When You Die Without a Will in Texas

Losing a loved one in the Kingwood or Northeast Houston area is difficult enough. When you discover there's no will, the stress and confusion can feel overwhelming. Many local families find themselves in this exact situation, unsure of where to even begin. At The Law Office of Bryan Fagan, we want you to feel understood and supported, so we’ve broken down the basics.

The good news is that Texas law has a default plan. The system hinges on a crucial distinction between community property (most things acquired during a marriage) and separate property (assets owned before the marriage, or received as a gift or inheritance).

The distribution rules are fairly straightforward:

- If there's a surviving spouse but no children, the spouse generally inherits everything.

- If there are children but no spouse, the children split the estate equally.

- Parents or siblings only come into the picture if there is no surviving spouse or any descendants.

How Intestacy Laws Actually Work

The specific rules are laid out in Chapter 201 of the Texas Estates Code. It’s the official playbook for these situations.

For families here in the Kingwood, Humble, or Porter areas, this means working with the Harris County probate courts to get the process started. Knowing how things work locally can make a huge difference.

The state’s laws are very precise. For instance, if a person dies leaving a spouse and children, the spouse keeps their half of the community property, and the children inherit the other half. It gets even more complex with separate property. This is where many families get tripped up. You can learn more about Texas intestate succession on LLS Law for a deeper dive.

Texas Intestacy Distribution At a Glance

To make this a bit clearer, here is a simple table that shows how property is generally divided. Think of this as a cheat sheet for the most common scenarios faced by Kingwood families.

| Surviving Heirs | Share of Community Property | Share of Separate Property |

|---|---|---|

| Spouse, no children | The spouse keeps 100%. | The spouse inherits 100%. |

| Spouse & children (from that marriage) | Spouse keeps their 50%; children inherit the other 50%. | Spouse inherits 1/3; children inherit the remaining 2/3. |

| Children, no spouse | N/A (No community property) | Children inherit 100%, divided equally. |

| Spouse, no descendants, but parents survive | Spouse keeps 100%. | Spouse inherits all personal property and 1/2 of the real estate. Parents inherit the other 1/2 of real estate. |

This table covers the basics, but every family's situation is unique, and things can get complicated fast, especially with blended families or complex assets.

Key Takeaway: When there is no will in Texas, the law prioritizes legal family ties to determine who inherits. Verbal promises or informal wishes, unfortunately, don't hold any weight in court.

Your Family’s Next Steps: A Practical Guide

Once the heirs are identified based on these rules, someone needs to be put in charge. The Harris County probate court will appoint an administrator to manage the estate.

This person has a lot of responsibility. They are tasked with gathering all the assets, paying off any debts, and eventually distributing what’s left to the rightful heirs. It’s a formal, step-by-step process that involves several key actions:

- Filing an Application for Letters of Administration with the Harris County probate clerk's office.

- Formally notifying all legal heirs and publishing a notice to potential creditors in a local newspaper serving the Kingwood or Humble area.

- Creating a detailed inventory of the estate's assets, getting appraisals if necessary, and filing this inventory with the court.

Navigating this process without a will can feel like you're on your own, but you're not. Our Kingwood office regularly helps families from Humble to Northeast Houston get through this with clear, supportive guidance. We encourage you to schedule a free consultation so you can understand your next steps and feel confident moving forward.

And if you're worried about a long, drawn-out court process, it’s worth looking into other options. We have a helpful guide to probate alternatives you might want to check out.

Why Understanding Intestacy Matters

Getting a handle on these rules provides immediate benefits during a tough time. It leads to faster decisions on what to do with bank accounts and real estate, it gives you a clear path forward in the Harris County courts, and it can seriously reduce family conflict by letting the law define who gets what.

One crucial point to remember is how the law treats separate property. Assets that were inherited or received as a gift are treated differently and will generally pass only to blood relatives. This means a child from a previous marriage has clear inheritance rights under Texas law, which can sometimes come as a surprise to families in the Kingwood area.

Knowing these basics empowers your family to make informed choices. If you need probate support from a local, client-focused firm, don't hesitate to reach out.

First Things First: Finding the Heirs and Taking Stock of the Estate

When a loved one passes away without a will, those first few days are a blur of grief and confusion. But before you can even think about court filings or legal proceedings here in Kingwood, there are two critical, hands-on tasks you need to tackle: figuring out who the legal heirs are and what, exactly, your loved one owned. This is the groundwork, and getting it right makes everything that follows much smoother.

It all begins with a methodical search for assets. Think of yourself as a financial detective, creating a complete snapshot of the estate. This goes way beyond the obvious, like the house in Kingwood or the car in the garage. You’ll need to sift through mail, file cabinets, and personal papers to find every last piece of the financial puzzle.

Putting Together a Complete Asset Inventory: A Step-by-Step Approach

For most of the Northeast Houston families we work with, this is easily the most labor-intensive part of the whole process. Your goal is a comprehensive list of everything from bank accounts and stocks to furniture and jewelry. This detailed inventory isn't just for your own records; it's a mandatory requirement for the Harris County probate court.

Start by hunting down these key documents:

- Bank and Investment Statements: Gather recent statements for every checking, savings, retirement (like a 401k or IRA), and brokerage account you can find.

- Property Deeds: You'll need the deeds for any real estate, whether it’s the family home in Humble or a tract of land elsewhere.

- Vehicle Titles: Track down the titles for all cars, trucks, boats, or RVs.

- Insurance Policies: Life insurance is a big one. While these policies often pay out directly to a beneficiary and bypass probate, the information is still a vital part of the total financial picture.

- Tax Returns: The last few years of tax returns are a goldmine of information, often revealing income sources or assets you never knew existed.

This isn't just about making a list. It's about organizing the raw data the court will need to see and that you'll need to eventually distribute the estate fairly.

How the Law Identifies Heirs: A Practical Explanation

In Texas, simply knowing who's in the family isn't enough when there's no will. The legal system requires a formal court proceeding to officially declare who the heirs are. This is called a Determination of Heirship, and it’s a non-negotiable step in an intestate probate.

You’ll file an Application to Determine Heirship with the probate court. This is a formal request asking a judge to legally establish, on the record, who is entitled to inherit according to Texas law.

This isn’t as simple as just submitting a form. Once the application is filed, the court appoints an attorney ad litem. This is an independent attorney whose sole job is to investigate and represent the interests of any unknown or missing heirs, ensuring no one with a rightful claim is left out.

You will also need two disinterested witnesses to testify in court. These are people who knew your loved one well but stand to gain nothing financially from the estate. They’ll provide testimony under oath about your loved one’s family history—marriages, divorces, children born in or out of wedlock—to corroborate the facts in your application.

What if an heir is a minor or lives out of state? The process is the same, but with a few extra layers. A minor’s inheritance might be managed by a court-appointed guardian. An heir living in another state will be formally notified and has every right to be involved, often hiring their own local lawyer to represent their interests.

Getting this stage right is absolutely crucial. A precise inventory and a court-ordered Determination of Heirship create the legal foundation you need to move forward. For our clients here in Kingwood and Humble, we can't stress enough how much organization at this stage helps prevent delays and headaches later. If you're feeling buried under a mountain of paperwork and questions, you don’t have to figure it all out on your own. The Law Office of Bryan Fagan is here to help you get organized and build a solid foundation. We are a local firm providing trusted representation right in Kingwood; schedule a free, no-obligation consultation at our Kingwood office to talk about your next steps.

Navigating the Texas Probate Court Process

For most families in Kingwood, the idea of heading to court adds a whole new layer of stress to an already difficult time. When a loved one passes away without a will, however, the Texas probate court system is the official path forward for settling their affairs. Let's break down what that actually means, because understanding the roadmap can make the journey feel much less intimidating.

The court’s job is to provide a supervised, legal framework to get assets from the person who passed away to their rightful heirs. It’s a formal process that makes sure debts get paid and everything is distributed exactly according to Texas law.

The Role of the Estate Administrator

Without a will naming an executor, the court steps in to appoint someone to manage the estate. In Texas, we call this person an Administrator. This is often the surviving spouse, an adult child, or another close relative who is willing and able to take on the role.

Being an Administrator comes with a significant legal responsibility known as a fiduciary duty. This is a legal term that means you must act in the best interest of the estate and its heirs, not your own. Your main jobs will include:

- Rounding up all the estate’s assets. This means taking control of everything from bank accounts and real estate to personal belongings.

- Notifying creditors and paying off legitimate debts. You’ll use the estate's funds to settle the decedent's final bills.

- Filing a detailed inventory of the estate with the Harris County court, listing all assets and their values.

- Distributing whatever is left to the legal heirs once the court gives the final go-ahead.

It's a big job, and we always recommend having legal guidance to make sure every step is handled correctly.

A Better Way: Streamlining the Process with Independent Administration

Thankfully, Texas law provides a much more efficient and less expensive option for many families called Independent Administration. This process lets the Administrator handle most of the estate’s business—like paying bills or selling property—without having to run to the judge for permission every single time. This saves a massive amount of time and money on legal fees.

Here's the key: to get an Independent Administration when there’s no will, every single legal heir must agree to it in writing. If even one person objects, the court will likely require a more supervised (and costly) Dependent Administration. For most families we work with in the Humble and Kingwood area, getting everyone on the same page for this is a huge win.

Key Insight: Independent Administration is the gold standard for intestate estates in Texas. It cuts down on court oversight, lowers costs, and speeds things up considerably. Getting all the heirs to agree is the single most important step to making it happen.

Your First Day in a Harris County Probate Court

The whole process officially kicks off when you file an "Application for Letters of Administration and Determination of Heirship" with the Harris County Clerk. This document gets the ball rolling and sets a date for your first court hearing.

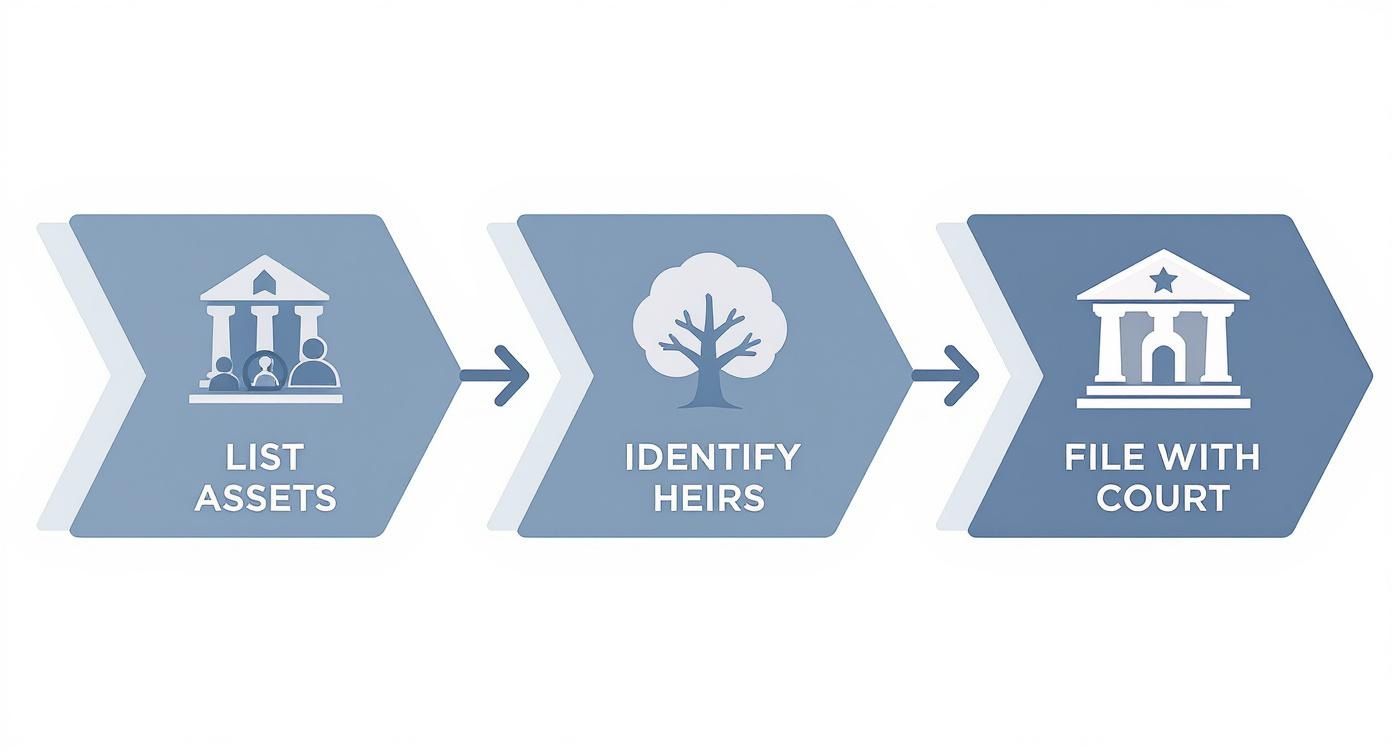

Here's a quick look at how those initial steps flow, from gathering your information to that first court filing.

Think of this as the essential prep work you need to do before your first court appearance. Being prepared makes all the difference.

At that hearing, the judge needs to officially identify the decedent's legal heirs. To do this, you’ll need to bring two "disinterested witnesses"—these are people who knew your loved one but have zero financial stake in the estate. They’ll testify about the family history. Once satisfied, the judge will appoint the Administrator and grant them Letters of Administration, the official document that gives them the legal power to act for the estate.

Don't wait to get started. There's a critical deadline in Texas probate law known as the 'Four-Year Rule.' As laid out in Texas Estates Code §256.003, you generally must start probate proceedings within four years of the person's death. Missing this window can seriously complicate things and limit your options, which is why acting promptly is so important.

While the court process has its differences when there is a will, seeing how that works can still be helpful. You can learn more by checking out our guide on how to probate a will in Texas for a side-by-side comparison.

Trying to face the court system on your own can feel overwhelming. At The Law Office of Bryan Fagan, our Kingwood attorneys are in the Harris County probate courts regularly. We guide our neighbors in Northeast Houston through every filing and hearing, making sure the process is as clear and smooth as it can be. Call our local Kingwood office for a free consultation to talk about how we can help.

When a Full Probate Isn't Necessary: Options for Smaller Texas Estates

The idea of going through a full, formal probate process can be daunting, especially when you're also dealing with the loss of a loved one. We see families in Porter, Humble, and all over the area worry about how much time and money it will all take. The good news is, Texas law understands this. Not every estate needs the full court-supervised treatment.

If the estate you're handling is on the smaller side and isn't complicated, you might have much simpler and more affordable paths available. These alternatives are designed to save families like yours a great deal of stress and expense by providing a legal way to transfer property without constant court oversight.

The Small Estate Affidavit: A Simpler Route for Many

For a lot of families in Northeast Houston, the best tool in the toolbox is the Small Estate Affidavit, often just called an "SEA." Think of it as a sworn statement filed with the court that basically says, "This estate is small and straightforward, so we don't need a formal administrator." It’s a much faster and significantly cheaper way to handle probate without a will in Texas when the situation fits.

But—and this is a big but—the SEA comes with a strict set of rules. It’s not a one-size-fits-all solution. To qualify, you have to be able to check every single one of these boxes:

- The person died without a valid will.

- The estate's total assets (not counting the homestead and other exempt property) are worth $75,000 or less.

- The value of the assets is greater than the total amount of debt.

- The only piece of real estate, if any, is the decedent's primary home (their homestead).

- You can identify every legal heir, and every single one of them agrees to sign the affidavit.

This is a fantastic option for simple situations. For instance, imagine a Kingwood resident passes away leaving a paid-off car, a checking account with a few thousand dollars, and their personal belongings. The SEA would likely be the perfect, streamlined solution for their family to transfer those assets.

A Quick Word of Warning: While the Small Estate Affidavit is a powerful legal tool, it isn't a magic key. Some banks or financial institutions can be stubborn and might still insist on seeing formal Letters of Administration signed by a judge before they'll release funds. It's always a smart move to call the bank first and ask about their specific policy for SEAs.

Getting the Affidavit Done Right

The SEA form itself is quite detailed. You’ll need to list out all the assets and their fair market value, along with all known debts. The most critical part, though, is identifying every single legal heir as defined by Texas intestacy law, complete with their addresses and the specific share of the estate they are entitled to receive.

The biggest practical challenge can be rounding up all the signatures. Every heir must sign the document in front of a notary. If you have a cousin living out of state or a relative who's just hard to pin down, this step alone can cause frustrating delays. Once it's finally complete and signed, the affidavit is filed with the Harris County Clerk. If the judge approves it, that document becomes your legal authority to go out and collect the assets.

Other Potential Avenues to Explore

While the SEA is the most common probate alternative, it’s not the only one. Another option you might hear about is the Affidavit of Heirship. This is used almost exclusively to transfer title to real estate when there’s no will. It completely bypasses the courts. Instead, two people who knew the decedent but don't stand to inherit anything sign a sworn statement detailing the family history. This affidavit is then filed in the county property records.

It can work, but many title companies see it as a weaker solution than a formal court order, which can sometimes create headaches if you try to sell the property down the road. For a deeper dive into these kinds of strategies, you can explore our comprehensive guide on how to avoid probate in Texas.

Ultimately, choosing the right path forward depends entirely on the unique facts of your situation—what kind of assets are involved, their total value, and how well all the heirs get along. Knowing these options exist is the first step toward finding the most efficient and compassionate way to settle the estate.

Navigating these alternatives can still be tricky, and a small mistake on an affidavit can get it rejected by the court or a bank. At The Law Office of Bryan Fagan, our Kingwood attorneys can sit down with you and figure out if your loved one's estate qualifies for one of these simpler processes. We’re here to give our neighbors clear, practical advice. Schedule a free consultation with us today to talk through your options.

How to Manage and Distribute the Estate

Once the Harris County probate court hands you the official "Letters of Administration," you're not just a family member anymore; you're the estate's Administrator. This is a huge responsibility. Legally, you're now a fiduciary, a term for someone who must act with complete loyalty and good faith, always putting the estate's best interests ahead of their own. For our neighbors here in Kingwood, grasping this duty is the first step toward a smooth process.

This new role comes with a specific to-do list designed to wrap up your loved one's affairs legally and ethically. The first few months are a whirlwind, but they set the stage for everything that follows.

Your Critical First 90 Days: A Practical Checklist

The clock starts ticking the moment you're appointed. You have a few non-negotiable deadlines early on.

- Within one month: You need to publish a "Notice to Creditors" in a local newspaper that serves the Kingwood area. This is a public announcement telling anyone the decedent owed money that it's time to file a claim.

- Within two months: For any known secured creditors—like a mortgage company or a car lender—you must send them a formal notice directly via certified mail. This ensures they're officially in the loop.

- Within 90 days: This is the big one. You have to file a document called the "Inventory, Appraisement, and List of Claims" with the court. This is an exhaustive, detailed list of every single asset the person owned, from their house in Northeast Houston down to the last dollar in their savings account, valued at the date of their death.

This Inventory is a sworn statement, filed under penalty of perjury. Getting the details right isn't just good practice; it's a legal command. Cutting corners here will cause major headaches and delays with the court down the road.

Handling Debts and Paying Claims

After you've sent out the notices, the claims from creditors will start coming in. It's your job to sift through them, determine which are legitimate, and pay them from the estate's funds.

These debts often include:

- Final hospital bills and funeral costs

- Credit card balances

- Mortgage payments and car notes

- Everyday utility bills

What if there isn't enough cash on hand? You may have to sell some of the estate's assets, like a car or even property, to cover the debts. You can't just decide to do this on your own; you'll need the court's permission first, and this is where having an experienced attorney is a lifesaver. Keep in mind that Texas law prioritizes certain debts. For instance, funeral and medical expenses usually get paid before unsecured credit card bills.

The Final Steps: Distribution and Closing

Once all the legitimate debts are settled and the mandatory creditor waiting period is over, you’ve reached the final leg of the journey: distributing what's left to the legal heirs.

But you can't just start writing checks. First, you must go back to the court and file an application for permission to distribute the assets according to the rules of probate without a will in Texas. The judge will carefully review an accounting of everything you've done—all the assets you've gathered and all the debts you've paid.

If it all checks out, the judge will sign an "Order of Distribution." This court order is your green light and your specific roadmap, telling you exactly who gets what.

After you've distributed the property and collected signed receipts from every single heir, you'll file one last document: a "Closing Report" or "Application for Discharge." This tells the court, "My job is done." When the judge approves it, you are officially released from your duties as Administrator, and the estate is finally closed.

Serving as an Administrator is a marathon, not a sprint, filled with legal deadlines and potential missteps. You don't have to navigate it alone. At The Law Office of Bryan Fagan, our Kingwood attorneys provide the clear, compassionate guidance you need. We invite our neighbors in Humble, Porter, and across Northeast Houston to schedule a free consultation with us to ensure the process is handled right from the very beginning.

Why You Need a Local Kingwood Probate Attorney

https://www.youtube.com/embed/hjaBKrOE4KY

It’s tempting to try and handle an estate on your own, especially when you’re trying to save money during a difficult time. But navigating a probate without a will in Texas is a minefield of potential problems. The legal rules are strict, court procedures are formal, and one small misstep can cause major delays, rack up extra costs, or worse, ignite painful family disputes. This is precisely where having an experienced, local attorney in your corner is not just a good idea—it's essential.

A probate lawyer does more than just fill out forms. Think of us as your strategic guide, helping you see around corners and anticipate issues before they become full-blown crises. From making sure the Determination of Heirship is done right to properly notifying creditors and dealing with unexpected debts, a lawyer helps you avoid the common mistakes that can derail the entire process.

The Advantage of Local Experience

When you’re in front of a Harris or Montgomery County probate judge, local knowledge is a game-changer. An attorney who is in these specific courts day in and day out knows the unwritten rules, the judges' preferences, and the clerks' exact procedures. You simply can't get that kind of insight from a generic online guide.

For families in Kingwood, Humble, and the surrounding Northeast Houston area, this local expertise translates into a much smoother and more efficient process. We know exactly what information the court expects in an inventory, the right way to publish notices in local papers, and how to present your case clearly and effectively at hearings.

Choosing a local firm means you're not just hiring a lawyer; you're partnering with a team that's part of your community. We are your neighbors, and we’re committed to providing compassionate, focused support when you need it most.

Protecting Your Family and the Estate

Perhaps the most important role an attorney plays is that of a buffer and a problem-solver. It’s not uncommon for disagreements to flare up between heirs over who should be in charge or how assets should be split. A lawyer can step in, mediate the conflict, and find a legal path forward that helps preserve those crucial family relationships.

You don't have to walk through the complexities of the Texas probate system by yourself. At The Law Office of Bryan Fagan, we offer the clear, supportive guidance you need to move forward. We invite our neighbors from Kingwood to Porter to schedule a free, no-obligation consultation at our local office. Let's talk about your situation and how we can protect your family's interests.

Your Top Questions About Probate Without a Will

When you’re trying to settle an estate without a will, a lot of questions pop up. It’s a confusing time, and families in Kingwood and across Harris County often come to us with similar concerns. Here are some of the most common questions we get, with practical answers to help guide you.

How Long is This Going to Take?

That's usually the first thing everyone wants to know. For a very straightforward intestate case, you might be looking at six to nine months from start to finish. But honestly, it's more common for things to stretch out to a year or even longer.

The timeline really hinges on the specifics of the estate. If heirs start disagreeing, unexpected debts surface, or the Harris County court docket is backed up, you can count on delays. It’s just the nature of the process.

For a deeper dive into what influences the timeline, you can explore our detailed guide on how long probate takes in Texas.

What If We Can't Find an Heir?

This is a more frequent problem than you might imagine, especially with blended families or relatives who have lost touch. The court doesn't just let you move on; it requires a serious, good-faith effort to track down every single legal heir.

If your search comes up empty, the judge will appoint what’s called an "attorney ad litem". This is an independent lawyer whose only job is to conduct a formal search for the missing person and protect their legal interests throughout the case. It’s a necessary step to ensure the entire process is legally sound.

Pro Tip: Don't assume a missing heir's share gets divided among the rest of the family. If the attorney ad litem can't find them, their inheritance is usually paid into the court's registry or held by the state. This is a tricky area where having an experienced attorney is invaluable.

Can We Sell Mom and Dad's House During This Process?

Yes, you can, but you can’t just put a "For Sale" sign in the yard. Selling real estate during an intestate probate is a court-supervised affair.

First, the administrator must be officially appointed by the court and receive their Letters of Administration. This document is their proof of authority.

Then, the administrator has to convince the judge that the sale is necessary. This usually means proving the money is needed to pay estate debts or showing that selling the house is the best move for all the heirs involved. The administrator needs a specific court order authorizing the sale before any deal can be legally closed.

Trying to navigate the probate process on your own can feel like an impossible task. The Law Office of Bryan Fagan – Kingwood TX Lawyers is here to offer the clear, compassionate, and local legal support you deserve. We’re proud to serve our neighbors in Kingwood, Humble, and Northeast Houston. Schedule your free, no-obligation consultation with us today, and let's find a clear path forward together.