Picture your estate having a "fast pass" that lets it skip the long lines at the Texas probate court and go straight to your loved ones. That's essentially what non-probate assets are. For families here in Kingwood, these tools are specifically set up to transfer directly to a named person when you pass away, completely bypassing the public and often lengthy court process.

Understanding Non-Probate Assets in Texas

When someone in Texas passes away, their estate usually has to go through a court-supervised process called probate. This is where a judge validates the will, ensures all debts are paid, and then signs off on distributing what's left. For many families in Kingwood and Humble, probate can be a drawn-out, stressful ordeal during an already difficult time.

Non-probate assets are your ticket around that.

Think of it like this: your will is a set of instructions for a judge to follow. A non-probate asset, on the other hand, has its transfer instructions built right in. This is almost always done through a simple beneficiary designation.

A beneficiary designation is a powerful, legally binding instruction on an account or policy that dictates exactly who gets that asset. Crucially, as Texas law stands, this designation will almost always override what you've written in your will for that specific asset.

This straightforward tool is what allows certain parts of your estate to move quickly and privately to the people you intended them for, right here in our Northeast Houston community.

How These Assets Work for You

Getting a handle on the difference between probate and non-probate assets is one of the cornerstones of smart estate planning. For families here in Kingwood, using these tools correctly can mean the difference between a smooth transition for your loved ones and a frustrating legal mess.

Here’s a quick look at what makes them so valuable:

- Direct Transfer: The asset goes straight to your beneficiary without waiting for a judge's permission.

- Speed and Efficiency: Your loved ones can often access the funds or property in weeks, not the months or even years probate can take.

- Privacy: Probate is a public court proceeding. These transfers are private transactions between the financial institution and your beneficiary.

- Reduced Costs: Skipping the formal court process can save your estate a significant amount in legal fees and court costs.

Learning to identify and manage your non-probate assets is a huge first step in building a plan that truly protects your family’s future. For a more detailed comparison, you can learn more about how probate and non-probate assets differ in Texas from our guide.

Why Bypassing Texas Probate is a Game-Changer for Your Family

To really appreciate why non-probate assets are such a powerful tool in estate planning, it helps to understand the court process they let you skip entirely: probate. For many families in Harris and Montgomery Counties, their first real brush with the Texas legal system is when a loved one passes away and they have to navigate the probate courts.

At its core, probate is the formal, court-supervised procedure for validating a will, settling the deceased's debts, and officially passing their property on to the heirs. It sounds straightforward, but it's rarely simple or quick. The reality involves filing petitions, showing up for court hearings, publishing notices to potential creditors, and compiling a detailed inventory of everything the person owned.

This mandatory court oversight often throws a wrench into what is already an incredibly difficult and emotional time for a family.

The Real-World Headaches of Texas Probate

A thoughtfully crafted estate plan is all about making life easier for the people you leave behind. The probate process, unfortunately, often achieves the exact opposite.

Here’s a look at the top reasons families in Northeast Houston and beyond want to steer clear of it:

- Long, Frustrating Delays: Probate moves at the speed of the court system, not the speed of your family's needs. It can easily lock up critical assets for months—and sometimes well over a year. During that time, your family may be cut off from funds they desperately need.

- It Costs Real Money: The court doesn't work for free. Filing fees, attorney's bills, and various administrative costs all get paid directly out of the estate. Every dollar spent on probate is a dollar that doesn't go to your heirs.

- Your Family's Business Becomes Public: Because probate is a public court case, everything filed becomes public record. This includes the will, a detailed list of assets (and their values), and the names of everyone who inherits. Anyone can walk into the courthouse and look it up.

For families here in Kingwood, this means that assets like a 401(k) or IRA can pass directly to a named beneficiary, sidestepping probate delays that typically run 6-18 months and can eat up 3-7% of the estate's total value in fees. In the U.S., where pension assets make up a huge slice of personal wealth, smart estate planning with a firm like The Law Office of Bryan Fagan ensures that money gets where it needs to go without a hitch. You can get a sense of the scale of these assets by looking at global wealth trends in a comprehensive 2023 report.

Avoiding probate isn't just a clever legal maneuver. It's a compassionate and practical way to shield your family's finances and privacy when they are at their most vulnerable.

A Practical Goal for Kingwood Families

Once you understand these hurdles, the true value of non-probate assets snaps into focus. Every single asset you structure to bypass probate is one less thing that has to be inventoried, appraised, and signed off on by a judge before your family can access it. While dealing with the legal side, there's also the physical side of settling an estate; using an ultimate estate cleanout checklist can be a lifesaver for managing tangible property.

Taking these steps ahead of time is fundamentally about keeping control over what you've built. The attorneys at The Law Office of Bryan Fagan are part of the Kingwood community, and we’re dedicated to helping our neighbors build estate plans that are private, secure, and efficient.

If you're worried about how probate could impact your family down the road, we invite you to our Kingwood office for a free, no-pressure consultation. We'll listen to your story, look at your situation, and give you clear, actionable advice on protecting both your assets and your loved ones.

Key Types of Non Probate Assets for Your Estate Plan

So, you understand the concept of a non-probate asset, but what does that actually look like in your own life? That's the next critical step. For most families here in Kingwood, these types of assets are probably already part of your financial picture. The real trick is recognizing them and making sure they're set up to do exactly what you want them to do.

These are the tools designed to transfer ownership automatically when you pass away, based on instructions you’ve already set. They get to skip the line at the courthouse. Let’s walk through the most common types you’ll run into here in Texas.

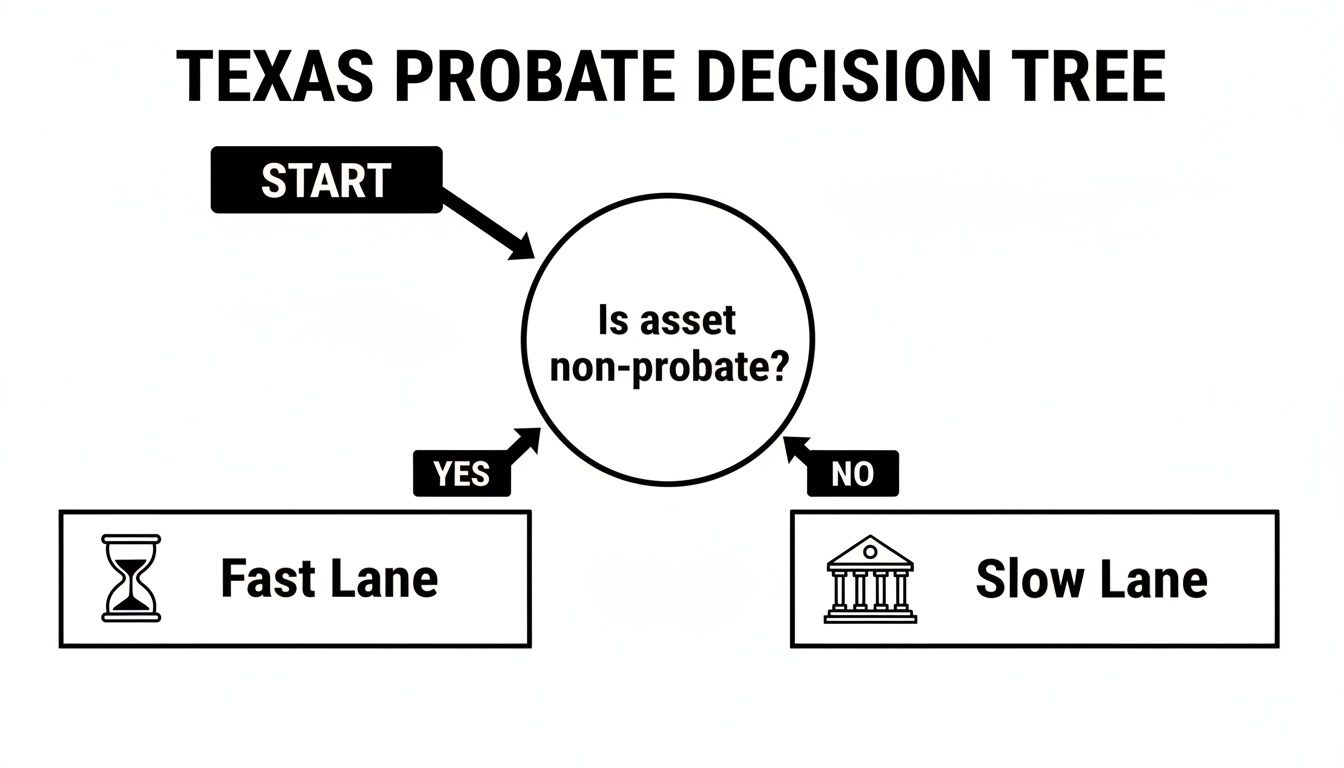

Think of it like this: after a death, every asset has to go down one of two paths. Non-probate assets get the fast lane, while everything else gets stuck in the slow lane, waiting for a judge's approval.

This flowchart makes it pretty clear. A simple "yes" or "no" on an asset's status completely changes the journey for your heirs, which is why getting this right is so important for our clients in Kingwood and Humble.

Assets With Beneficiary Designations

This is by far the most common and powerful group of non-probate assets. At their core, these are just contracts you have with a financial company where you name a specific person (or several people) to inherit the account when you die. It’s a direct, private transfer.

You see these all the time:

- Life Insurance Policies: The death benefit is paid straight to the beneficiaries you've listed on the policy itself.

- Retirement Accounts: This includes your 401(k), IRA, 403(b), and similar pension plans. The money goes directly to whoever you named.

- Annuities: Much like life insurance, the funds in an annuity contract pass directly to your designated beneficiary.

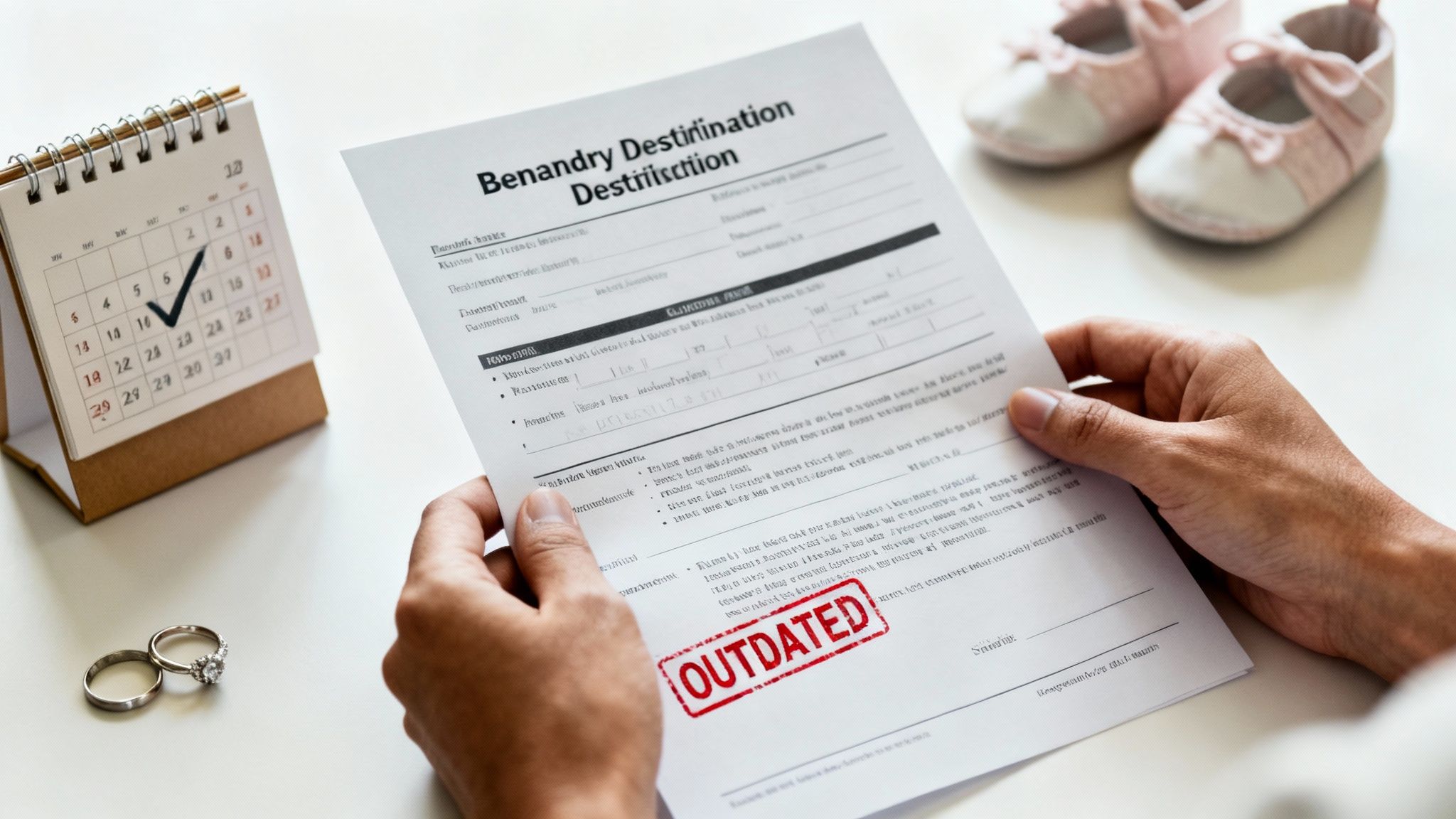

It's crucial to understand that these designations are legally binding contracts. In almost every situation, they will override whatever you’ve written in your will. This is why keeping your beneficiaries updated after big life events like a divorce or a new child is absolutely essential.

Bank and Investment Accounts With Transfer Clauses

Many families in Humble and Porter rely on special account registrations to make sure cash and investments can be accessed quickly, without waiting for a court. These are surprisingly simple yet effective tools that are easy to set up with your bank or brokerage.

- Payable-on-Death (POD) Accounts: You can add a POD instruction to checking accounts, savings accounts, and even CDs. The person you name simply has to show a death certificate to the bank to get the funds.

- Transfer-on-Death (TOD) Registrations: This is the same idea but for your investment portfolio—stocks, bonds, and mutual funds. Your beneficiary works with the brokerage firm to have the securities transferred into their name.

Think of POD and TOD designations as built-in instructions for your financial accounts. They tell the institution exactly what to do when you're gone, removing any guesswork and avoiding the need for a probate court order.

Property Owned With Rights of Survivorship

In Texas, the way you title property you own with someone else makes a huge difference. When property is owned as "Joint Tenants with Right of Survivorship" (JTWROS), it automatically becomes a non-probate asset.

When one owner passes away, their share instantly and automatically goes to the surviving joint owner(s). This is a very common way for married couples in Northeast Houston to own their home or a joint bank account. The key phrase that must be in the deed or account agreement is "right of survivorship."

Assets Held in a Revocable Living Trust

A revocable living trust is probably the most flexible and comprehensive tool for avoiding probate altogether. A trust is a private legal entity you create to hold the title to your assets. You appoint a "trustee" (which is usually you, to start) to manage everything.

Once you transfer assets—like your house, bank accounts, or investments—into the name of the trust, they technically aren't part of your personal estate anymore. After your death, your chosen successor trustee steps in to manage and distribute the assets according to the private rules you laid out in the trust document, keeping everything completely out of the probate court.

Trusts offer the ultimate in privacy, control, and flexibility. To see how they fit into a bigger estate plan, you can learn more about the key differences between a will and a trust from our in-depth guide.

To help you see how these different assets function, here's a quick comparison of the most common options for Texas families.

Comparing Common Non Probate Assets in Texas

This table breaks down the most common types of non-probate assets, how they are transferred to beneficiaries, and key considerations for Kingwood families.

| Asset Type | How It Transfers | Best For | Key Consideration |

|---|---|---|---|

| Retirement Accounts & Life Insurance | Direct payment to named beneficiaries listed on the policy/account. | Providing direct, liquid funds to specific individuals. | Beneficiary designations override your will. Keep them updated! |

| Payable-on-Death (POD) Bank Accounts | Beneficiary presents a death certificate to the bank to claim funds. | Simple, direct transfer of cash without court involvement. | Only transfers cash assets; does not allow for complex instructions. |

| Transfer-on-Death (TOD) Brokerage Accts | Beneficiary works with the firm to transfer securities into their name. | Passing on stocks, bonds, or mutual funds without selling them. | Beneficiary receives the assets with their original cost basis (a tax detail). |

| Joint Tenancy with Right of Survivorship | Surviving joint owner(s) automatically absorb the deceased's share. | Married couples owning a primary home or joint bank account. | All owners have equal access and control during their lifetimes. |

| Revocable Living Trust | Successor trustee distributes assets according to the trust's terms. | Comprehensive probate avoidance, privacy, and control over asset distribution. | Requires the proactive step of retitling assets into the trust's name. |

Each of these tools has a specific job to do. The best estate plans often use a combination of them to make sure every asset is handled efficiently and according to your wishes.

At The Law Office of Bryan Fagan, we help Kingwood families look at the whole picture, reviewing every asset to find the best strategies for a seamless transfer. Schedule a free consultation with our team to ensure your estate plan is built for efficiency and gives you peace of mind.

The Power—and Pitfalls—of Beneficiary Designations

Many of the most powerful tools for avoiding probate come down to one simple, yet often forgotten, detail: the beneficiary designation. Think about it—it's that form you filled out years ago for your 401(k) or life insurance policy, naming the person you wanted to inherit it.

What most people don't realize is that this single piece of paper is a powerful, legally binding contract. It's a direct instruction to the financial institution, and here’s the critical part: it almost always overrides whatever your will says. If your will leaves everything to your children, but that old IRA still lists an ex-spouse, guess who gets the money? Your ex.

This clash between a will and an old beneficiary form is one of the most common and heartbreaking mistakes we see in our Kingwood practice. A simple oversight from a decade ago can completely disinherit a loved one.

Common Mistakes That Can Derail Your Entire Plan

Life for families in Kingwood and Humble moves fast. But when it comes to your beneficiary forms, a "set it and forget it" mindset is a recipe for disaster. One outdated form can completely unravel your careful estate planning, sending a major asset to the wrong person or, ironically, forcing it right back into the probate process you worked so hard to avoid.

Here are the most frequent missteps we help our clients correct:

- Failing to Update After a Divorce: This is the classic scenario. You finalize a divorce but forget to remove your former spouse from a life insurance policy. While Texas law might void their claim under a will, it doesn't always automatically cancel a beneficiary designation. This can easily lead to a messy and expensive legal battle for your intended heirs.

- Forgetting to Add New Children: When a new baby arrives, they aren't automatically included on your existing accounts. You have to physically contact each company and update your forms if you want all your children to inherit a share of that asset.

- Not Naming a Contingent Beneficiary: What happens if your primary beneficiary passes away before you do? Without a backup, or "contingent," beneficiary named on the account, that asset often has nowhere to go but back into your estate. And that means it has to go through probate.

The single most important habit for managing your non probate assets is a regular review. We tell our clients to pull out their policies and account statements at least once a year—or immediately after any major life event—to make sure their wishes are still accurately reflected.

The Real Cost of Neglecting These Forms

Thoughtful estate planning helps your family sidestep the time, expense, and stress of probate. Yet, with only 32% of Americans even having a will, the reliance on non-probate tools is greater than ever. But when beneficiary designations are mismanaged, they can drag these otherwise efficient assets right back into the court system you wanted to avoid. The global impact of such oversights on family wealth is significant, as detailed in a recent global wealth report.

Imagine a Kingwood resident who named her mother as the beneficiary on a large investment account years ago. Her mother passes away, but she never gets around to updating the form. When she later dies, that account is now "stuck." With no living beneficiary, it must be probated, triggering the very delays and legal fees she thought she had prevented.

Being proactive is the only way to make sure your plan actually works. For more strategies on keeping your estate out of court, take a look at our guide on how to avoid probate in Texas. Here at The Law Office of Bryan Fagan, we can conduct a thorough review of your assets to spot these hidden risks. Call our Kingwood office today for a free consultation and let's make sure your legacy is secure.

Building a Cohesive Estate Plan in Kingwood

Knowing about tools like beneficiary designations and joint ownership is a great first step. But the real key is learning how to weave these non-probate assets together with your will and other legal documents. The goal is to create a single, seamless plan that works exactly the way you want it to, with no loose ends.

For our clients here in Kingwood, Humble, and across Northeast Houston, this is where true peace of mind is found. It’s not about picking one tool over another. It’s about making them all work in harmony to protect your family and your legacy. A well-built plan doesn't have any gaps.

Why Your Will Is Still the Cornerstone

Even if you manage to structure most of your major assets to bypass probate, a will remains an absolutely essential document for every adult in Texas. It's a common and dangerous mistake to think that non-probate tools make a will unnecessary.

A will handles critical jobs that beneficiary designations simply can't:

- Naming Guardians for Minor Children: This is, without a doubt, the most important function of a will for parents. It's the only place you can legally name who you want to raise your kids if you can't. Without a will, that deeply personal choice is left in the hands of a judge.

- Covering "Leftover" Assets: There will always be personal property that doesn't have a title or a beneficiary form—think furniture, jewelry, cars, or family heirlooms. Your will acts as the instruction manual for who gets these sentimental and often valuable items.

- Creating a Safety Net: Life happens. What if you forget to name a beneficiary on an account? What if your chosen beneficiary dies before you do? A will’s "residuary clause" acts as a catch-all, directing where any overlooked assets should go and preventing them from being distributed according to impersonal state laws.

A will makes sure that no part of your estate is left to chance. It gives your executor a clear roadmap for any assets that fall outside of your non-probate strategy.

The Revocable Living Trust as Your Central Hub

For many Kingwood families who want the most control, privacy, and flexibility, a revocable living trust can serve as the central hub of their estate plan. Think of a trust as a private container you create to hold your property. You then transfer ownership of your assets—your house, investment accounts, business interests—into the name of this trust.

You remain in complete control as the trustee while you're alive. But after you pass away, the assets inside the trust do not go through probate. Instead, your chosen successor trustee simply steps in and distributes the property according to the private instructions you've already laid out in the trust document.

A trust is the ultimate tool for managing both probate and non-probate assets cohesively. It can be named as the beneficiary of your life insurance or 401(k), allowing you to control not just who inherits the money, but how and when they receive it.

This level of control is incredibly useful for protecting young beneficiaries, providing for a loved one with special needs, or ensuring a large inheritance is managed responsibly over many years.

Creating a Truly Complete Plan

Putting together a plan that truly reflects your wishes means looking at the big picture. You have to review your beneficiary designations, property deeds, and financial accounts right alongside your will and any trusts. The goal is to make sure every single asset has a clear, predetermined path to its intended recipient.

At The Law Office of Bryan Fagan, we are dedicated to helping our neighbors in the Kingwood community do just that. We don't just draft documents; we help you build a complete, personalized strategy. Our process starts with a thorough review of your assets and goals to ensure your plan is efficient, private, and legally sound.

Protecting your family’s future is too important to leave to a patchwork of disconnected accounts and outdated forms. If you're ready to build a cohesive estate plan that provides lasting security, we invite you to our Kingwood office for a free, no-obligation consultation. Let us help you put all the pieces together.

Let a Kingwood Attorney Help Secure Your Family's Future

Navigating the ins and outs of estate planning can feel like a maze, but it doesn't have to be. When you boil it down, a few core truths stand out.

Making smart use of non probate assets can save your family a massive amount of time, money, and stress. But these tools only work if your beneficiary designations are kept perfectly up to date. Ultimately, nothing replaces the security that comes from having a comprehensive plan in place.

These aren't abstract legal theories or strategies just for the ultra-wealthy. They are powerful, practical steps that every family in Kingwood, Humble, and the greater Northeast Houston area can take. A well-crafted estate plan is a final gift to your loved ones—it replaces confusion and conflict with clarity and peace during an incredibly tough time.

Your Neighbors in Estate Planning

Here at The Law Office of Bryan Fagan, we're not just lawyers; we're members of this community. We live and work here, so we have a firsthand understanding of the specific goals and concerns that families in our area face. Our job is to listen to your story and translate complex Texas laws into a straightforward, effective plan that protects your legacy.

We truly believe every Kingwood family deserves an estate plan that safeguards their assets and makes sure their wishes are followed, no exceptions.

Protecting your family’s future is the most important reason to have an estate plan. It’s about ensuring security and providing for your loved ones with a clear, private, and efficient transfer of your legacy.

Don't leave something this important to chance or boilerplate online forms. We invite you to come into our Kingwood office for a free, no-obligation consultation. Let's talk about what you want to achieve and map out a plan that gives you and your family the lasting peace of mind you deserve.

Schedule your free consultation today.

Answering Your Questions About Non-Probate Assets in Texas

Once you get the hang of the basics, it's natural to have questions about how non probate assets play out in the real world. Estate planning is deeply personal, and every family in Kingwood has a unique story. To help bring some clarity, we've put together answers to a few of the most common questions we hear from our neighbors.

Can My Will Override My Life Insurance Beneficiary?

No, and this is probably one of the most important takeaways. In Texas, the beneficiary you name on an asset like a life insurance policy or a 401(k) creates a binding contract. That designation will almost always beat whatever your will says.

Think about it this way: if your will leaves everything to your spouse, but an old life insurance policy still has your brother listed from years ago, the insurance company is legally bound to pay your brother. This is precisely why our Kingwood team stresses the importance of making sure every single piece of your estate plan is in sync to avoid these kinds of devastating conflicts.

What Happens If I Name a Minor as My Beneficiary?

You can do it, but it creates a legal mess that can completely derail your intentions. Banks and insurance companies simply cannot hand over large sums of money directly to a child.

When this happens, you force the court system to get involved. A judge will have to appoint a legal guardian to manage the money until the child turns 18. This process is expensive, public, and full of restrictions—the very things you were likely trying to avoid in the first place.

A much smarter approach, and one we often set up for our Kingwood clients, is to create a trust for the child. You then name that trust as the beneficiary. This gives you total control over when and how the money is used for their education, health, and future.

Should I Use a Transfer on Death Deed for My Home?

For a lot of Texas homeowners, a Transfer on Death Deed (TODD) can be a wonderfully simple and effective tool. It lets you pass your house or other real estate directly to someone you choose, keeping that property completely out of the probate court. It’s affordable to set up, easy to revoke if you change your mind, and works great for straightforward situations.

But a TODD isn't a one-size-fits-all solution. If you have multiple properties, a blended family, or potential creditor problems, it might not be the right move. The only way to know for sure is to talk it through with an experienced Kingwood estate planning attorney who can look at your specific goals.

Do I Still Need a Will If All My Assets Are Non-Probate?

Yes. 100% yes. A will is a foundational legal document for every adult in Texas, no matter how many non-probate assets you've arranged.

Here are a few reasons why it's still non-negotiable:

- It names guardians for your children. This is the big one. Your will is the only legal document where you can name the person you want to raise your kids. Without one, a judge who doesn't know you or your family will make that choice.

- It acts as a safety net. What about that old savings account you forgot about, or a property you inherit unexpectedly? A will covers any assets that might have slipped through the cracks.

- It handles your personal stuff. Your will is where you decide who gets the sentimental items—the jewelry, the art, the family heirlooms that don't have a title but mean the world.

A well-built estate plan leaves nothing to chance, ensuring every base is covered.

Working through the details of non probate assets takes a careful eye and a solid grasp of Texas law. Here at The Law Office of Bryan Fagan – Kingwood TX Lawyers, we're here to offer the personalized guidance you need. We invite you to schedule a free, no-pressure consultation at our local Kingwood office to make sure your legacy is protected and your loved ones are taken care of.