For families in the Kingwood area, understanding the difference between a will and a trust is the first real step in protecting your legacy. It’s a common point of confusion, but the distinction is crucial for your family's future. A will is a legal document outlining how your property should be distributed after you die. The key thing to remember is that it only becomes active after death and almost always has to go through the public court process known as probate right here in Texas.

A living trust, on the other hand, operates very differently. It’s a private legal entity you create to hold your assets for your beneficiaries. It’s active the moment you create and fund it, and one of its biggest advantages is that it typically avoids the probate process altogether, keeping your family's affairs private.

Will vs. Trust: The Core Differences Explained for Kingwood Families

When you start planning for your family's future, the legal jargon can feel overwhelming. But for our clients in Kingwood, Humble, or Northeast Houston, the choice between a will and a trust really comes down to a handful of key ideas. Think of it this way: both a will and a trust are tools designed to make sure your assets get to the people you want, the way you want. The routes they take to get there, however, are worlds apart.

A Last Will and Testament is what most people think of as the cornerstone of estate planning. It’s essentially an instruction manual for the probate court, spelling out who gets what when you’re gone. It’s also the primary place where you name a guardian for your minor children—a non-negotiable task for any young family in our Kingwood community. But a will’s instructions are only carried out after your death, and it requires a judge’s approval in a Texas court to be executed.

A revocable living trust works more like a private contract that you create and control during your lifetime. You start by transferring ownership of your major assets—like your Kingwood home, bank accounts, or investments—from your individual name into the name of the trust. Don't worry, you're still in the driver's seat as the trustee, managing everything as you always have. When you pass away, the person you named as your successor trustee can step in and distribute the assets directly to your beneficiaries, no court involvement needed.

For many Texas families, the most important difference comes down to control and privacy. A trust gives you both during your lifetime and after death, while a will is a public record that only works through the court system after you die.

To break it down even further, let's look at a quick side-by-side comparison.

Will vs. Trust: A Quick Comparison for Texas Residents

This table gives you a high-level summary of the main distinctions between a will and a trust, making it easy to see the differences at a glance for our Kingwood clients.

| Key Feature | Last Will and Testament | Revocable Living Trust |

|---|---|---|

| When It's Active | Only after death | Immediately upon creation and funding |

| Probate Required | Yes, it must go through probate court | No, it typically avoids probate |

| Privacy | Public record once filed in court | Private document, not filed publicly |

| Incapacity Plan | No, requires a separate power of attorney | Yes, a successor trustee can manage assets |

| Upfront Cost | Generally lower | Generally higher |

As you can see, the choice isn't just about what happens when you're gone. It’s also about managing your affairs if you become unable to, maintaining your family’s privacy, and making the process as smooth as possible for your loved ones in Northeast Houston.

How a Will Works: The Texas Probate Process

https://www.youtube.com/embed/Hi5epLariAQ

When a resident of Kingwood or Humble passes away with only a will, there's a common misconception that their assets just seamlessly transfer to the people named in the document. That’s simply not how it works under Texas law. Instead, the will must be validated by a Texas court through a formal, and often lengthy, process called probate.

This is probably the single most important distinction between a will and a trust: a will always requires court intervention to have any legal effect.

This court-supervised procedure is designed to confirm the will is legally sound, settle any outstanding debts, and ensure assets are distributed exactly as the deceased intended. For families in Northeast Houston, this usually means a trip to a Harris or Montgomery County courthouse to kick off the legal proceedings.

One of the biggest eye-openers for families we work with is that this process makes the will—and by extension, your family's financial affairs—a public record. Anyone can walk into the courthouse and look up the details of your estate, from who your beneficiaries are to what they inherited. This complete lack of privacy is a major reason why many people in the Kingwood area look for other options.

The Steps of Texas Probate

The probate process isn't a single event; it's a series of steps that can feel overwhelming for a grieving family. While every estate is different, the journey generally looks like this:

- Filing the Will: The person named as executor in the will starts the process by filing an application with the proper Texas probate court. This is the official beginning of the legal case.

- Validating the Will: The court schedules a hearing to legally recognize the will and formally appoint the executor. Once appointed, the executor receives "Letters Testamentary," which is the legal document giving them authority to act for the estate.

- Notifying Creditors: The executor is required to formally notify any known creditors. They also have to publish a general notice in a local paper to alert any unknown creditors, giving them a window to file claims against the estate.

- Inventorying Assets: A detailed inventory of every single estate asset must be created, appraised, and filed with the court. This includes everything from the family home in Porter to bank accounts, vehicles, and personal belongings.

For Kingwood families, the key takeaway is that probate is neither quick nor private. It’s a deliberate, court-managed process built for thoroughness, which often means more time, public scrutiny, and legal costs for your loved ones.

It’s surprising how many people put off formal estate planning. Recent data shows that only 24% of American adults have a will, and an even smaller 13% have set up a living trust. This is a noticeable drop from past years, signaling a worrying trend of delaying these critical decisions. Discover more insights into these estate planning trends.

This reality really highlights why it’s so important to understand the tools you choose. The probate process can place a heavy burden on a family already dealing with loss, which is why so many people actively look for strategies for probate avoidance in Texas. Only after all debts are paid and assets are gathered can the executor finally distribute what's left to the beneficiaries and officially close the estate.

How a Trust Works: Gaining Privacy and Control

While a will is a solid tool that relies on the court system, a trust provides a powerful, private alternative for managing your estate. For many families right here in the Kingwood area, the real draw of a revocable living trust is its ability to sidestep the probate court process completely. This gives you and your loved ones far more control and keeps your affairs out of the public eye.

Think of a trust as a private legal entity you create to hold your most important assets. When you set one up, you—the grantor—transfer the legal ownership of your property into the trust's name. This could be your Kingwood home, your investment accounts, or even a family business.

In the beginning, you almost always act as your own trustee, which just means you keep full control. You can buy, sell, and manage the assets just like you always have. Your day-to-day life doesn't change a bit. The important shift happens on paper, where your assets are now legally owned by the trust, not by you personally.

The Role of the Successor Trustee

The true power of a trust really shines when you can no longer manage your own affairs. As part of setting it up, you'll name a successor trustee—a person or institution you trust implicitly—who is legally empowered to step in and manage the trust if you become incapacitated.

This is a critical advantage for anyone in Northeast Houston planning for the future. A will does absolutely nothing for you while you're alive, but a trust creates a seamless transition of control without any court intervention. It ensures your bills get paid and your assets are managed and protected, no matter what happens to you.

A trust is a living document. It works for you while you're alive and for your family after you're gone. Its primary job is to keep your family's financial life out of the public record and away from the costs and delays of probate court.

After you pass away, your successor trustee continues their role. Their job is to distribute the trust's assets directly to the people you’ve chosen as beneficiaries, following the exact instructions you left behind. This whole process happens privately and efficiently, without a judge needing to sign off on every step.

Funding Your Trust Is Non-Negotiable

Just signing the trust documents isn't enough. A trust is an empty container until you "fund" it by formally retitling your assets in its name. This is a step people sometimes forget, but it's essential.

Here’s what that looks like in practice for a local resident:

- The deed to your house in Porter would be changed to show the "John Smith Family Trust" as the owner.

- Your investment account name would be updated from "Jane Smith" to "Jane Smith, Trustee of the Jane Smith Family Trust."

Getting this part right is what makes the trust work and keeps your estate out of probate. This desire for control is a big reason the estate planning industry has grown so significantly, with an estimated $290.1 billion in revenue in 2025. You can learn more about the trusts and estates industry here.

This careful planning also extends to choosing the right kind of trust, as each has its own rules and benefits. To explore your options further, you can read our guide on the differences between a revocable trust vs. an irrevocable trust. For hands-on guidance with setting up and funding a trust here in Northeast Houston, our team at The Law Office of Bryan Fagan is ready to help you get it done right.

Comparing Your Options: A Side-by-Side Analysis

Deciding between a will and a trust can feel overwhelming, but for most families here in the Kingwood area, the right choice boils down to a few key differences. It’s really about what matters most to you: upfront cost, family privacy, control if you become incapacitated, and how quickly your assets get to your loved ones. Let's look at the real-world difference between a will and a trust so you can see how each one would actually work for your family.

When clients walk into our Kingwood office, one of their first questions is always about cost. It's true that a simple will is almost always cheaper to set up initially. But a trust, while it costs more to create, is specifically designed to bypass the Texas probate court system, which can rack up significant expenses later on—think attorney fees, court filing costs, and executor payments that can eat away at your estate.

Total Cost: Upfront vs. Long-Term

There's a persistent myth that trusts are only for the super-wealthy. The reality is that for many Humble and Porter families who own a home and have some savings, a trust can be the more financially savvy choice over the long haul.

- Will: You'll have a lower initial investment to get a will drafted and signed. The bigger bills come later when your estate has to pay for the probate process.

- Trust: The upfront cost is higher because you're not just creating the document; you're also formally transferring your assets into it. That investment, however, can save your family a substantial amount of money and time by avoiding probate entirely.

Privacy Level: Public vs. Private

How comfortable are you with your family’s financial business becoming public information? For many people in Northeast Houston, privacy is a huge deal.

Once a will is filed for probate in Harris or Montgomery County, it becomes a public court record. That means anyone—a nosy neighbor, a distant relative, a predatory salesperson—can go to the courthouse and see exactly what you owned, who you left it to, and how much they got. For many families, that level of exposure is a major drawback.

A trust is a completely private document. Its terms, assets, and beneficiaries are never filed with a court or made public. This is one of the single biggest advantages a trust provides for our Kingwood clients.

Think of a revocable living trust as a private set of instructions. Your hand-picked successor trustee simply follows your directions to distribute your assets, all without court interference or public scrutiny. This confidentiality is invaluable, protecting your loved ones from scams or unwanted attention when they are most vulnerable.

Control During Incapacity

Here’s a scenario many people don't think about: what happens if an illness or accident leaves you unable to manage your own affairs? This is where the difference between a will and a trust is night and day.

- Will: A will does absolutely nothing until after you die. It offers zero protection or authority for managing your finances if you become incapacitated. Your family would likely be forced into court to get a public, expensive, and often cumbersome guardianship established just to pay your bills.

- Trust: A trust is effective the moment you sign it. You designate a successor trustee who has the immediate legal power to step in and manage your assets if you're unable to. This ensures your mortgage gets paid and your investments are managed without any need for court intervention.

This built-in plan for incapacity is an incredibly powerful tool that brings enormous peace of mind. For a Kingwood resident, it means the person you trust is in charge, not a judge or a court-appointed stranger, protecting both your assets and your dignity.

When you're weighing your options, it's crucial to look beyond the basics. Here’s a more detailed comparison to help Texas families see how these two essential documents really stack up against each other.

Detailed Breakdown: Will vs. Trust for Texas Families

A comprehensive look at how wills and trusts stack up across critical decision-making factors for your estate plan.

| Factor | Last Will and Testament | Revocable Living Trust |

|---|---|---|

| Probate Required? | Yes. A will must go through the public probate court process to be validated and have assets transferred. | No. Assets held in the trust bypass probate entirely, allowing for a private and faster transfer. |

| Privacy | Public Record. Once filed, your will, asset list, and beneficiaries are accessible to anyone. | Completely Private. The trust document and your financial details remain confidential. |

| Control During Incapacity | None. A will is only effective upon death. A separate Power of Attorney is needed, or the court may appoint a guardian. | Built-in. Your chosen successor trustee can immediately manage your finances if you become incapacitated. |

| Time to Distribute Assets | Months to Years. The Texas probate process can be lengthy, delaying your beneficiaries' inheritance. | Weeks or Months. Assets can often be distributed much more quickly, as soon as debts are settled. |

| Upfront Cost | Lower. Typically less expensive to draft and execute. | Higher. More complex and costly to create and fund (transfer assets into the trust). |

| Long-Term Cost | Potentially Higher. Probate court costs, legal fees, and executor fees can add up significantly. | Potentially Lower. Avoids the high costs associated with the probate process, often saving the estate money. |

| Asset Protection from Creditors | Limited. Assets are exposed to creditors during the probate process. | Minimal (During Life). Offers little protection while you're alive but can include provisions for beneficiary protection. |

| Ease of Administration | Court-Supervised. The executor must follow strict legal procedures and report to the court. | Trustee-Managed. The successor trustee follows the private instructions in your trust without court oversight. |

This table lays out the core differences, but the best choice isn't just about features—it's about your specific family situation, your assets, and your goals for the future.

Choosing the Right Plan for Your Family

The best estate plan has nothing to do with picking the most complicated or expensive option. It's about finding the right tool for your family’s specific situation. To help you see the real-world difference between a will and a trust, let's walk through a few common scenarios we see with families right here in Kingwood and the greater Houston area. Your life, your assets, and your goals will ultimately point you to the best solution.

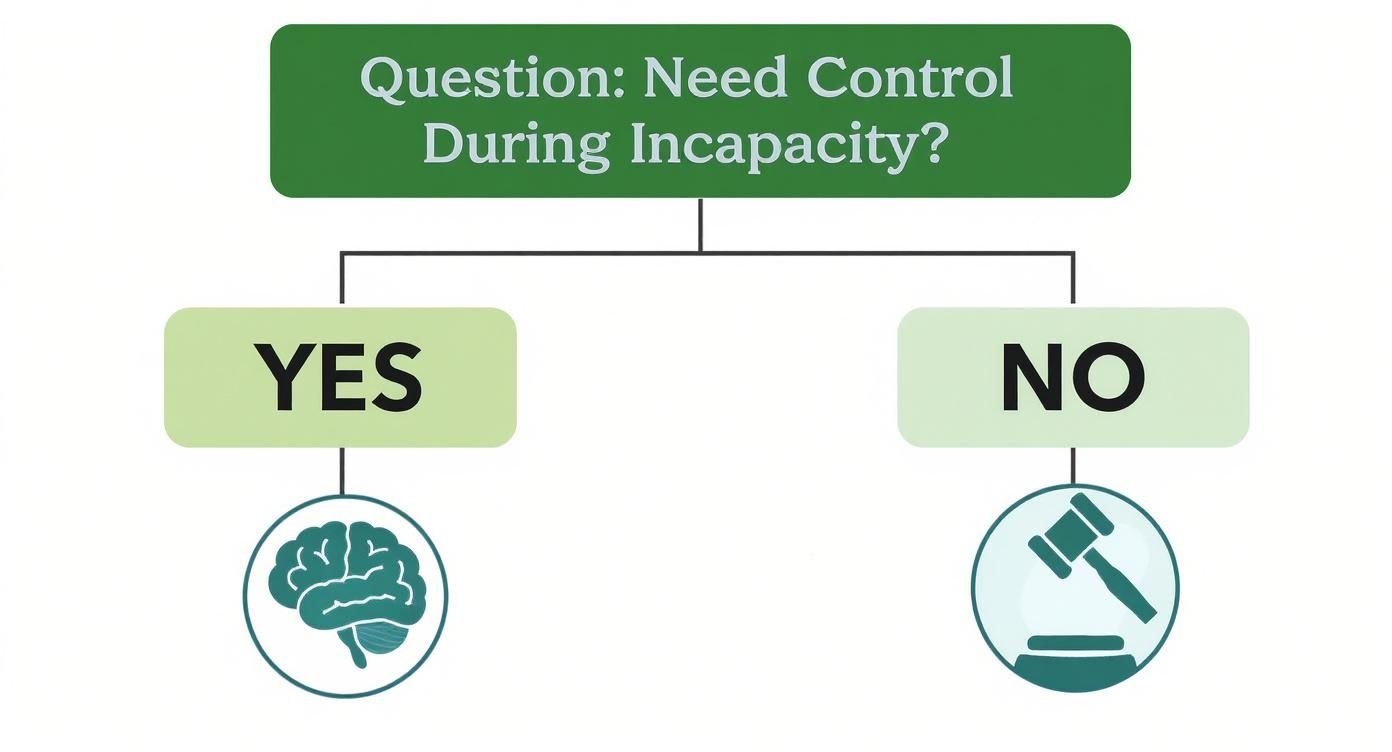

This decision tree infographic gets straight to the heart of the matter for many people: what happens if you can't manage your own affairs?

As you can see, planning for potential incapacity is one of the biggest reasons families lean toward a trust. It offers a layer of protection during your lifetime that a will simply doesn't have.

When a Will Makes Sense

In many common situations, a will is the most practical and efficient choice. Think of it as the essential foundation of any estate plan, especially for younger individuals and families.

Take a young couple in Porter with two small children, for example. Their main priorities are straightforward: appoint legal guardians for their kids and make sure their assets—a home, some savings—go to the right people if the unthinkable happens.

A will is the perfect fit for them. Here’s why:

- Naming Guardians: In Texas, a will is the only legal document you can use to formally nominate guardians for your minor children. For this family, that's non-negotiable.

- Simplicity: Their finances aren't overly complicated. A will directs their assets cleanly, and the probate process will be manageable for the person they choose as executor.

- Cost-Effectiveness: The upfront investment for a will is lower, which makes sense while they're building their careers and focusing on other financial priorities.

For a young Kingwood family, the will's power to name a guardian is its most important feature. It provides peace of mind that their children will be cared for by someone they trust, no matter what.

When a Trust Is the Better Fit

As your life gets more complex, a trust often becomes the more strategic choice. It gives you a level of control, privacy, and efficiency that a will just can't deliver.

Picture a blended family in Kingwood. The couple has children from previous marriages and wants to be absolutely certain their assets are divided fairly, leaving no room for disputes. A trust lets them create detailed, legally binding instructions for how and when assets are distributed—something a will can't handle with the same precision.

Or consider a Humble business owner planning for the future. A living trust can ensure a seamless transition of the business to the next generation or a new owner, avoiding the operational chaos a lengthy probate process could trigger.

A trust is the superior tool in these scenarios because it offers:

- Complex Asset Distribution: You get precise control over who inherits, what they inherit, and when they get it. This is invaluable for blended families or for protecting an inheritance for a spendthrift heir.

- Incapacity Planning: If you become unable to manage your affairs, your designated successor trustee can step in immediately without any court involvement.

- Privacy and Speed: Trusts keep your family’s financial business out of the public record. Assets can also be transferred to your loved ones much faster, since you bypass the probate court system entirely.

At the end of the day, deciding between a will and a trust is deeply personal. It comes down to your assets, your family dynamics, and how much control you want to maintain. You don’t have to figure it out on your own. The Law Office of Bryan Fagan is right here in Kingwood, ready to offer clear, practical guidance. Schedule a free consultation with us to talk through which path is right for protecting your family’s future.

Taking the Next Step With Your Kingwood Estate Plan

Knowing the difference between a will and a trust is a great start. But the next move—taking action—is what really protects your family's future. For those of us in Kingwood, Humble, and the surrounding Northeast Houston areas, the best way forward begins with a straightforward look at your assets and what you want to achieve.

Start by jotting down your major assets: your home, vehicles, bank accounts, and any investments. Then, give some serious thought to your family's specific situation. Do you have young children who will need a guardian? Are you managing the complexities of a blended family?

You don't have to figure all this out by yourself. Real peace of mind comes from making a confident choice in a supportive, pressure-free setting.

As a local law firm right here in the Kingwood community, we're focused on giving our neighbors practical, clear-headed advice. We invite you to come in for a free, no-obligation consultation at our Kingwood office to talk through your personal circumstances. Our team of experienced, client-focused attorneys is here to help you weigh your options and find the right path.

To see more about how we can help, take a look at our guide to Kingwood, Texas estate planning attorneys.

Common Questions We Hear About Wills and Trusts

When it comes to estate planning, it's natural to have questions. Here are a few of the most common ones we hear from our neighbors in Kingwood, Humble, and the surrounding areas, along with some straightforward answers based on Texas law.

Can I Have Both a Will and a Trust in Texas?

Absolutely. In fact, for a truly solid estate plan, we almost always recommend it. The two documents work together like a team. A special kind of will, known as a pour-over will, serves as a safety net.

Its entire purpose is to catch any assets you forgot or didn't get around to putting in your trust. After you pass away, the will simply "pours" those leftover assets into the trust, making sure everything ends up in one place and is managed according to your wishes.

Isn't a Trust Too Expensive for a Regular Family in Kingwood?

That's a common misconception. While it's true that setting up a trust costs more upfront than a simple will, it can save your family a considerable amount of money and heartache down the road. By keeping your estate out of the public, costly, and often lengthy Texas probate process, a trust becomes a smart investment.

For most families in Humble or Porter who own a home and have some savings, a trust isn't a luxury for the ultra-rich. It's a practical tool for protecting what you've worked so hard to build.

We often tell clients to think of a trust as paying more now to save your family much, much more later. The initial cost is often a fraction of the legal fees, court costs, and months of delay that can get tied up in probate.

Will a Living Trust Help Me Avoid Estate Taxes?

A standard revocable living trust won't do the trick for avoiding federal estate taxes on its own. Any assets inside it are still counted as part of your estate for tax purposes under current law.

However, if your family has significant assets that might trigger estate taxes, there are more advanced strategies we can explore. Special types of irrevocable trusts are designed specifically to minimize or sometimes even eliminate that tax bill. This is a highly technical area of estate planning, and getting expert legal advice from a local Kingwood attorney is non-negotiable to ensure it's done correctly.

Figuring out the best path forward between a will and a trust is a major step in securing your family's future. You don't have to sort through it all on your own. The experienced team at The Law Office of Bryan Fagan – Kingwood TX Lawyers is here to offer clear, compassionate guidance that fits your unique situation. We are local, experienced, and client-focused, ready to provide the trusted representation you deserve. Schedule your free, no-obligation consultation at our Kingwood office by visiting us at https://kingwoodattorneys.com today.